Oil Rebounds on Russia Sanctions

Yesterday, oil started the session over2% lower after OPEC officials scrapped plans for an emergency meeting in February. OPEC+ plans to keep to its scheduled meeting coming up in March. Russia is still considering the further cuts of 600 kbpd suggested by Saudi Arabia. Russia’s Energy Minister Alexander Novak and his Saudi Arabian counterpart Prince Abdulaziz bin Salman discussed the situation in the oil market and cooperation within OPEC+ by phone, the Russian ministry said in a statement. (Reuters)

The market recovered some losses yesterday and this morning after news broke that the US sanctioned a unit of Russia’s largest oil producer, Rosneft, for maintaining ties with Venezuela’s Nicolas Maduro and state-run oil company PDVSA. The US restrictions come with a three-month wind-down period that expires May 20. (Reuters)

Fighters loyal to eastern Libyan military commander Khalifa Haftar shelled the port of the capital, Tripoli, forcing a halt to shipping and leading to a suspension of talks to resolve the conflict in the country; the Tripoli-based internationally recognized government said it was suspending its participation in UN-backed talks in Geneva after the port’s bombardment Tuesday. (Bloomberg) Output is currently down to 123 kbpd while production was at 1.2 mmbpd before the blockade on Libyan ports by Haftar supporters in mid-January.

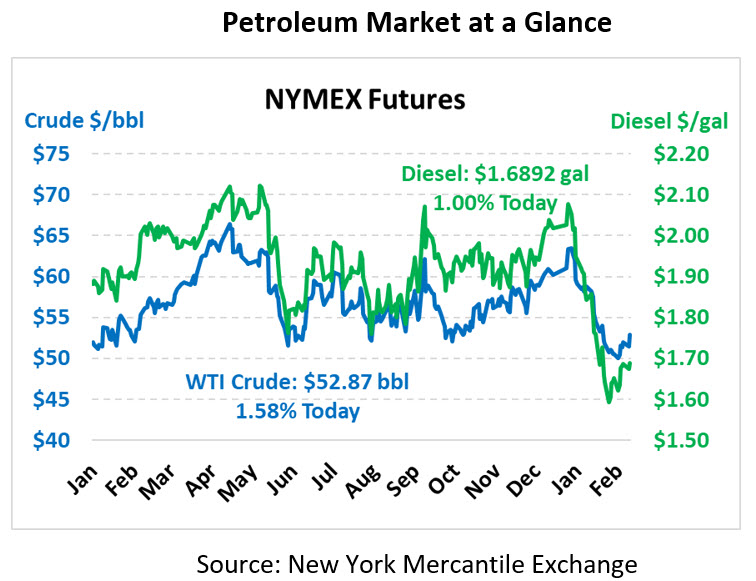

Crude prices are up this morning. WTI Crude is trading at $52.87, a gain of 82 cents.

Fuel is up in early trading this morning. Diesel is trading at $1.6892, a gain of 1.7 cents. Gasoline is trading at $1.6338, a gain of 1.9 cents.

This article is part of Crude

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.