Oil Rallies as Demand for Gasoline Rises

Yesterday, crude prices advanced sharply on bullish inventory news confirmed by the EIA. A smaller -than-expected build in crude stocks and a surprise draw in gasoline inventories helped move prices higher. Further supporting the rally in oil, the US Equities market rallied on news of a potentially useful drug treatment for the coronavirus. In addition, the US Fed stated that they were ready and willing to do whatever it takes to put the US economy back on track. We are seeing the crude market rally continue in early trading this morning.

Demand for gasoline increased for the third straight week after many states in the US begin to ease quarantine restrictions. We are on track for several more states to lift “shelter-in-place” orders after they expire today, including Texas, Florida, and Ohio. We can expect gasoline demand to continue to increase in the near future as businesses begin to reopen and personal travel returns to more normal levels.

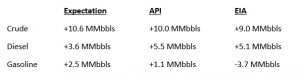

The EIA reported a smaller-than-expected rise for crude of 9.0 MMbbls, versus an expected increase of 10.6 MMbbls. At Cushing, the EIA reported that stocks rose by 3.6 MMbbls. Distillates reported a larger-than-expected build and are about 4% above the five-year average for this time of year. Gasoline reported a surprise draw. Gasoline inventories are about 10% above the five-year average but demand seems to be increasing as we gradually come out of quarantine.

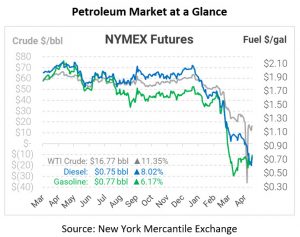

WTI Crude is trading higher this morning at $16.77, a gain of $1.71..

Fuel is up in early trading this morning. Diesel is trading at $0.7502, a gain of 5.6 cents. Gasoline is trading at $0.7721, a gain of 4.5 cents.

This article is part of Crude

Tagged: coronavirus, Draw, eia, gasoline, Quarantine

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.