Oil Prices Resilient Despite Bearish News

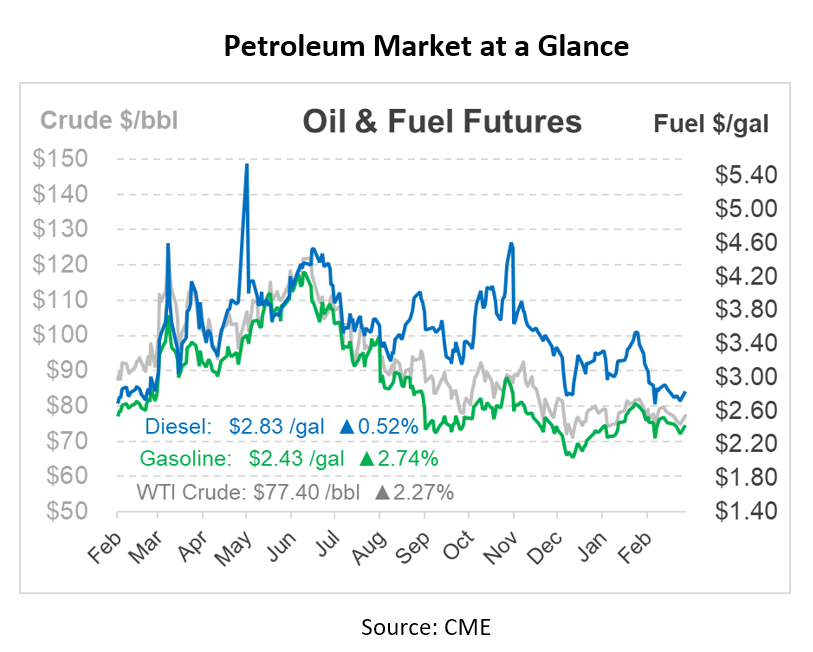

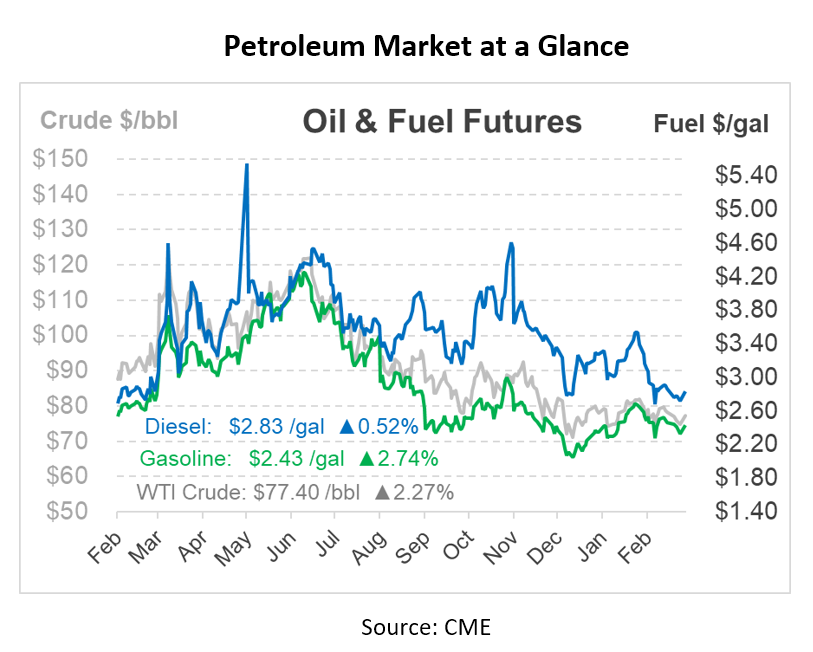

Bearish headlines have yet to crack the resilience of oil prices this morning. Retail gasoline and diesel prices are easing for consumers; however, crude oil is gaining traction with a $1/bbl higher trade than yesterday. Oil is still under pressure from recent refinery outages and anticipation of future stock builds.

Even though oil prices are trading slightly higher this morning, they are still on track to post their fourth straight monthly loss. This week, the market is anticipating new Chinese economic data and an update on US crude inventories, which could serve as bullish triggers. The fact that oil prices remain higher despite the recent trend of monthly losses is an indication of the underlying demand for oil.

Outages at a few American refineries helped to contain the rise in crude oil prices this morning. A Louisiana refinery and two Texas refineries were shut down for maintenance related to operational issues. Refinery outages can have a significant impact on crude oil prices, causing crude inventories to rise while refiners are unable to convert it into refined products.

Many are anxiously awaiting the American Petroleum Institutes’ (API) release of its weekly estimates for oil supply and demand later today. The API weekly estimates of oil supply and demand are closely watched by traders and analysts as they provide important insights into the state of the US oil market. If the API data shows further builds in US crude oil stocks, this would be seen as a bearish signal for oil prices, as it would suggest that supply is outpacing demand.

Predictions are indicating further builds in US crude oil stocks. To support those predictions, it should be noted that for eight consecutive weeks, the US has experienced stock builds, yet the market has refused to crumble despite bearish news. This also suggests that there are other factors at play supporting oil prices.

Furthermore, according to EIA statistics published last week, US oil stockpiles are at their highest levels since May of 2021. The market will use the API estimates from today as a guide for what the EIA inventory report will reveal regarding US crude and product inventories tomorrow.

Finally, the average retail price of gasoline and diesel are down this week, providing some relief to consumers. According to AAA, the average retail price of gasoline in the US is $3.3568/gal, indicating a 4.57-cent decline over the previous week. Diesel prices across the US are averaging at $4.409/gal, also indicating a decline in price from the previous week of 7 cents.

This article is part of Daily Market News & Insights

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.