Oil Prices Higher, Cube Technology being Assimilated

Oil markets continued their rebound on Friday, adding nearly a dollar in gains and bringing full-week gains to $1.78. Markets continue to focus on the drawdown of U.S. crude inventories, a surprising trend given the significant increase in U.S. crude production. OPEC’s cuts are counteracting rising production, and markets are once again putting their focus on the tightening supply markets.

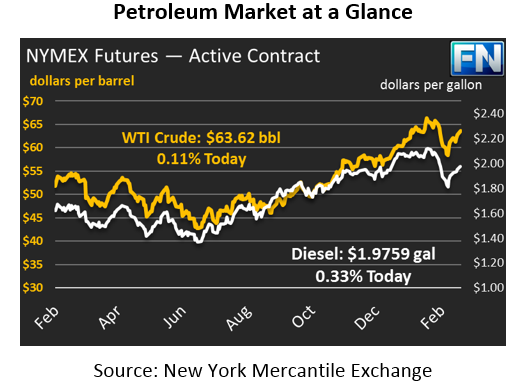

Oil prices this morning are trending flat, holding on to most of Friday’s gains but not advancing further. WTI crude prices are currently at $63.62, a tiny gain of 7 cents since Friday’s close. The trend for crude prices over the past week has been that prices stagnate in the morning, then launch higher during the market’s formal trading hours of 9am – 2:30pm. We’ll see if that trend continues today.

Refined fuels also saw large gains on Friday, with gasoline leading the way with a huge 4-cent, 2.4% increase. Diesel prices also rose, though only by 2.3 cents (1.2%). Today, diesel prices are picking up some small gains, rising 0.7 cents to trade at $1.9759. Gasoline prices are up roughly the same amount, picking up 0.6 cents to trade at $1.8149.

Net Length Falls Despite Higher Prices

Despite rising prices last week, managed money still cut its net length slightly according to Friday’s report, as demonstrated in the chart below. The blue bars show “smart money” net length, while the green shows crude oil prices. Higher net length usually accompanies higher prices – when more traders bet on oil prices rising rather than falling, they create buying demand without an accompanying selling demand. The fact that oil prices rose despite declining net length suggests that markets are rising for fundamental, rather than financial market-driven, reasons.

Cube Drilling Assimilated by US Producers

It’s no surprise that U.S. production has exploded in recent years. Technological innovations such as fracking and horizontal drilling, along with superior discovery techniques, have turned oil drilling from an art to a science. Now, it appears the next innovation in U.S. production will be massive “cube developments” – interlinked rigs drilled together to extract oil from multiple layers at once, rather than one at a time. While the approach is controversial in the industry given its higher cost, proponents say that improved economies of scale will make the rigs worthwhile in the long run. Given the long run savings of cube production, it appears that resistance is futile; producers will be assimilated to the cube over the long-term.

This article is part of Crude

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.