Oil Prices Could Fall Back Soon

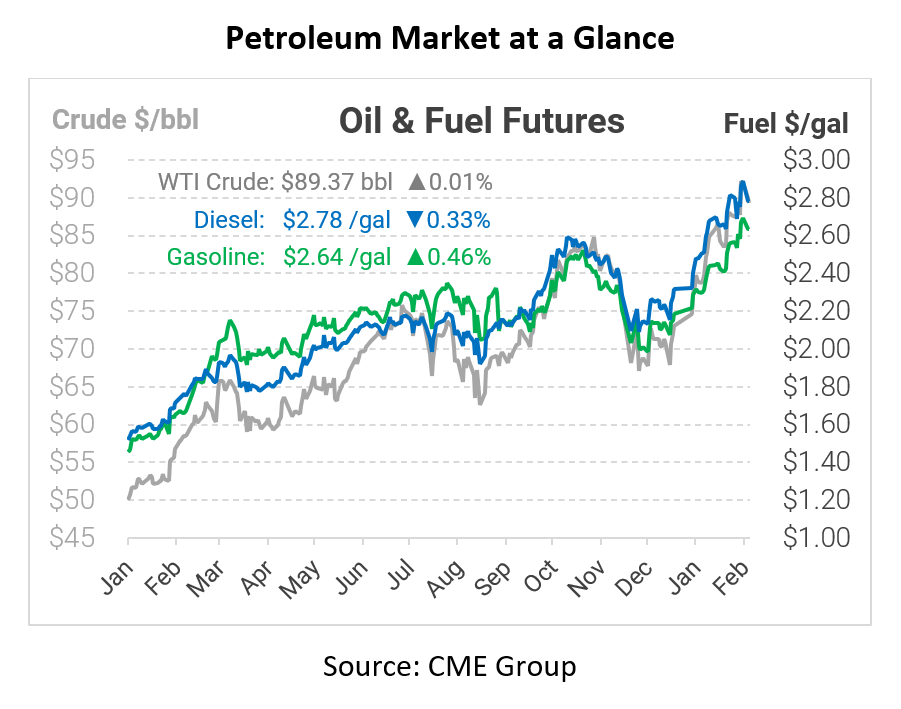

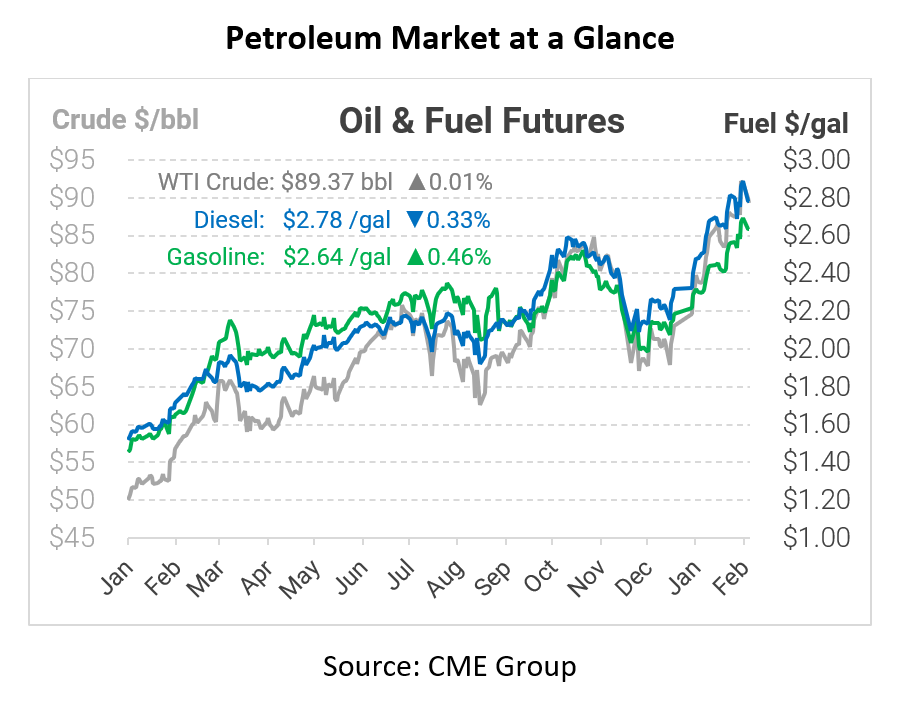

This morning WTI crude is sitting stable at around $89.46 as the public awaits the outcome of the Russia-Ukraine conflict and Iranian-US nuclear talks. Due to escalating geopolitical tensions around the globe, consumers have seen a rise of WTI by around 19%, reaching highs not seen since 2014. But many now suggest that one scenario could change the outlook of oil prices.

According to many market analysts, oil prices could fall significantly if the Russia-Ukraine conflict ends. One manager at DWS even suggests that we could see prices slide by almost 20% back to the $70/barrel mark, which seems like a distant memory. While prices have climbed above $92/barrel in 2022, the thought of more oil exports from Iran after the United States had indirect talks with the country is helping bring prices down. What could help even further is a de-escalation of the problems happening in the east right now.

Should the outcomes desired by many to bring prices down not come to fruition, the U.S. government has still said, “all options are on the table.” Americans already saw the Biden White House release 50 million barrels of crude from the strategic reserves, but that has done little to nothing to solve the problem of increasing prices that are around seven-year highs. Many are now trusting in the resolve of global conflicts driving prices upward. If these problems were to be solved soon, we could start to see prices pull back significantly.

This article is part of Daily Market News & Insights

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.