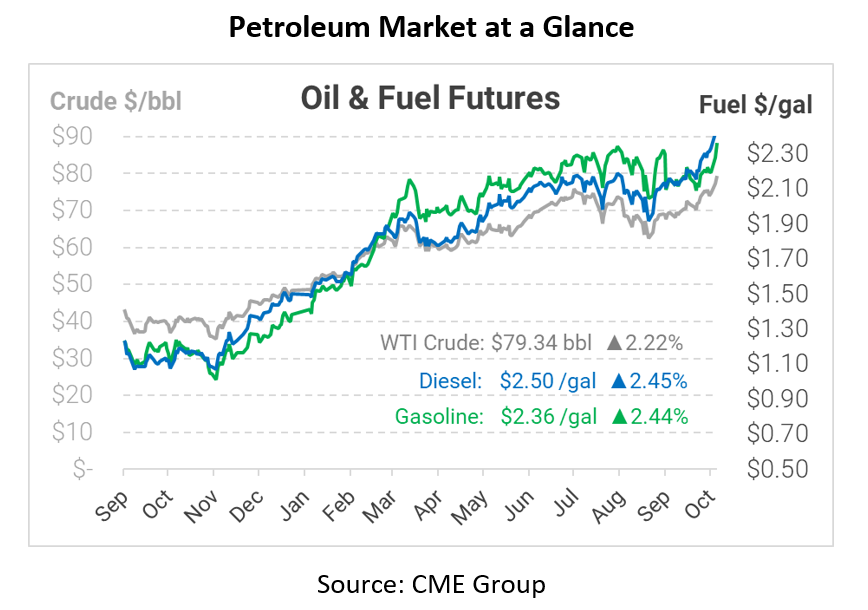

Oil Markets Hit 7-Year Highs, Fuel Prices Soar

Oil markets are experiencing some explosive growth this morning following news that OPEC is sticking to its current output strategy. Both diesel and crude oil are trading at 7-year highs, while gasoline trades close to multi-year highs. Post-pandemic supply chain challenges have been universal across different industries, and oil markets are beginning to feel it strongly.

OPEC+ is planning to keep to the current production arrangement, which includes increasing supply by just 400 kbpd per month. In context, the group is increasing global production by roughly 0.4% per month, when demand is growing much faster. OPEC+ members are fearful that rising COVID cases and faulty demand data in China threaten the demand recovery, and they don’t want to cause prices to go crashing lower.

Energy shortages in Europe and Asia are also bringing an element of fear to the market, as we covered last week. Goldman Sachs estimates that rising nat gas could cause some power generation plants to switch from NG to oil, resulting in an incremental 650 kbpd of oil demand in the future.

Looking back, the last time oil prices were this high was in 2014, as oil prices were falling from the $100/bbl range. Back then, tight OPEC supply and limited alternative production kept prices elevated. Today, US producers are once again on the sidelines for financial reasons, leaving OPEC to dominate fundamentals. As long as the group maintains its austere production quotas, expect prices to remain elevated. Conditions likely won’t improve until early 2022, when OPEC+ quotas will have increased enough to catch up to rising demand.

This article is part of Daily Market News & Insights

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.