Oil Markets Continue to Watch the Middle East for Direction

The New York Times reported yesterday that a contingency plan was presented to the Pentagon to deploy up to 120,000 additional troops to the Middle East. This action is thought to be a result of increasing tensions with Iran on their nuclear enrichment program and associated with the “specific and credible” intelligence sited by the Trump administration which suggested Iranian forces and proxies were targeting US forces in Syria, Iraq and at sea.

A deployment of this size is considered massive and comparable in size to the number of troops deployed to Iraqi in 2003 to protect Kuwait’s sovereignty. Prior to the deployment in 2003, the Bush administration educated and prepared the public on why such a massive deployment was necessary.

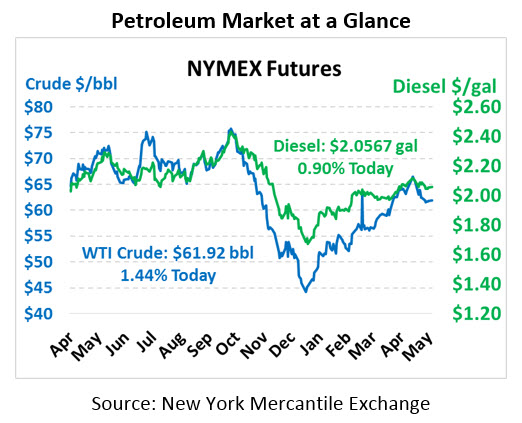

This type of communication and education has yet to be forthcoming from the current administration. Oil and equity market participants continue to closely monitor developments to guide direction. Oil markets are moving higher in early action today on the continuing tensions and uncertainty on how the Unites States will respond.

Weakness in the equities market globally weighed heavy on the futures market yesterday. Equities are in positive territory this morning and responding to consolatory comments from both U.S President Trump and Chinese representative even after the U.S. imposed new tariffs on Chinese goods and a corresponding increase from China on U.S. goods.

This article is part of Daily Market News & Insights

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.