Oil Hits New Post-Pandemic High on OPEC Meeting

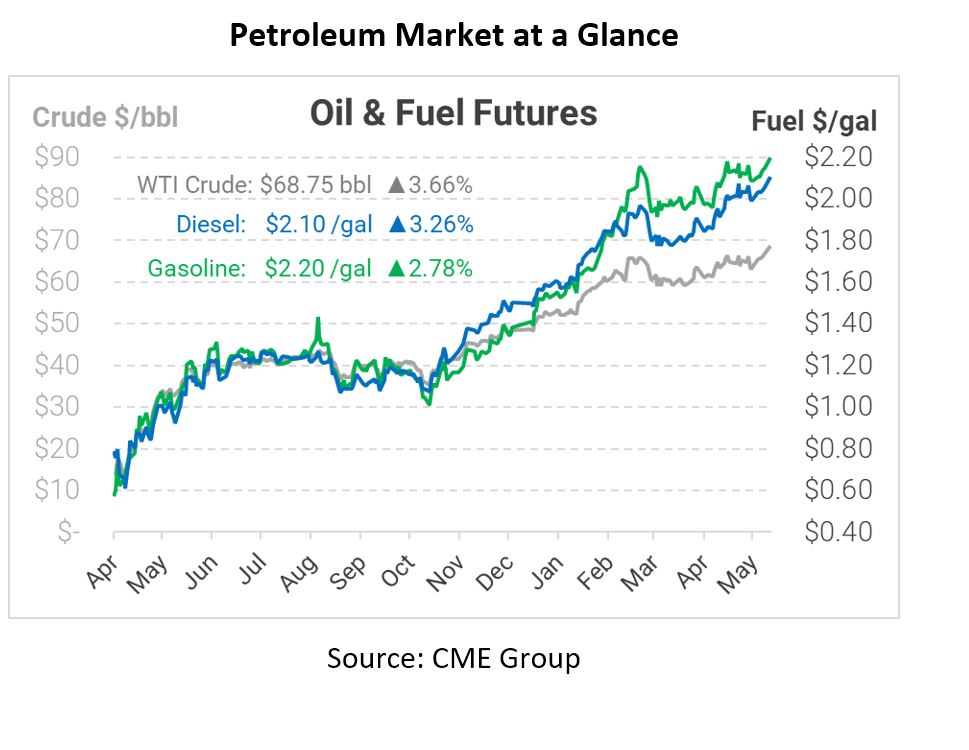

Oil prices are rocketing higher this morning as traders come off a long holiday weekend. On Monday, OPEC’s technical committee met to review oil market conditions. They concluded that oil demand would rise by over 6 million barrels per day (MMbpd) in the second half of the year. The critical question is how the group will respond to Iran barrels eventually returning. Although a US-Iran nuclear deal is far from complete, there’s still a possibility of the US lifting sanctions, allowing 2 MMbpd of Iranian supply to hit global markets.

Today, the group is meeting to review its production strategy, but markets expect OPEC+ to maintain its current incremental approach. In April, the group agreed to add 2 MMbpd of supply back slowly to global markets. At the height of the pandemic last year, OPEC+ agreed to cut 9.7 MMbpd; they will still be cutting 5.8 MMbpd by the end of July at their current pace. OPEC’s Secretary-General said Iran’s oil production would not cause them to change their approach while affirming that the group is monitoring the situation closely.

Adding to market enthusiasm, summer driving season is officially in full gear. Memorial Day kicks off the season as millions of Americans hit the road to celebrate with friends and family. Gasoline inventories are already clinging to the low end of historical inventory levels, signaling that supply could grow tight. Refiners are making their way back to historically normal utilization levels but are still lagging. If demand soars back to pre-pandemic levels before refiners can get back over 90% utilization, expect tight supply and higher gasoline prices this summer.

This article is part of Daily Market News & Insights

Tagged: oil high, opec, post pandemic

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.