Oil Hits New 2019 High, Nigeria to Join Saudis in Cuts

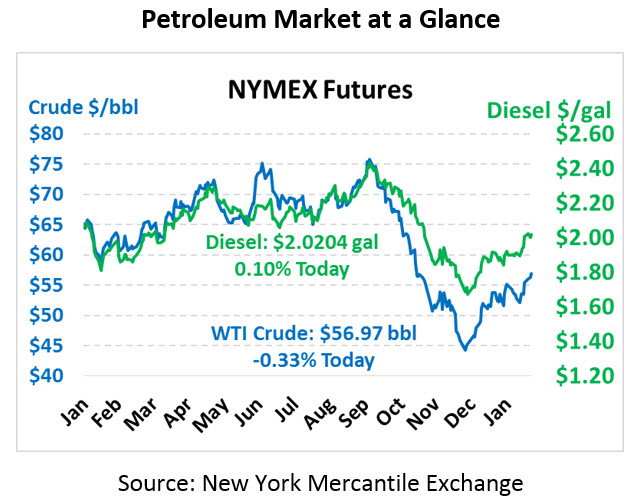

Oil is back on its way to higher prices amid continued focus on OPEC’s cuts. Crude picked up over 80 cents yesterday (1.5%) to set yet another 2019 high. From here, a clear break above $60 would signal a return to the ranges seen before the Q4 2018 bear drop. This morning, crude oil is trading at $56.97, largely unchanged from yesterday’s close.

Fuel prices are also relatively unmoved. Diesel prices are $2.0204 this morning, up just 0.2 cents after yesterday’s 2.4 cent gains. Gasoline is trading lower at $1.5940, down 0.4 cents after an impressive 3.4 cent gain.

Oil’s strong gains yesterday came following comments from Saudi Arabia’s energy minister indicating he hopes markets would be fully balanced by April – leaving two months of agreed OPEC cuts to whittle inventories down further. Saudi officials also secured Nigeria’s support in balancing markets. Although the country is already part of the OPEC deal, markets have speculated Nigeria may join Saudi Arabia in going above and beyond their commitment to balance oil inventories. Saudi Arabia needs oil at $80/bbl to balance their government’s budget, so expect Saudi influence to be a major factor in oil price developments this year.

The API, reporting a day late due to Monday’s holiday, presented generally bullish results in their inventory data. Crude builds were smaller than markets had anticipated, while both gasoline and diesel saw draws amid sustained low refinery utilization. The one bearish signal was Cushing crude stocks, which showed a large build following weeks of Keystone pipeline outages that saw Canadian crude re-routed from a Pakota, IL destination to Cushing.

This article is part of Crude

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.