Oil Hits $55, New Multi-Month High

Oil prices are rocketing higher this morning, and the main impetus seems to be OPEC making good on their production deal. A survey of January OPEC production showed the group only raised collective output by 190 kbpd, about two-thirds of the expected gains. Although most producers did increase output per the agreement, instability in Libya contributed a small output drop. In addition, Saudi Arabia’s voluntary 1 MMbpd cuts, which last through March, go into effect today. As the rally continues, major banks predict prices could go as high as $65/bbl this year.

Commenting on recent price trends, Mansfield’s SVP of Supply Andy Milton noted: “We are actually now backwardated (crude and ULSD), so all signs point toward needing more production to meet a future demand improvement. Side note, US dollar and DOW futures are higher as well.” Backwardation means future prices are lower than current prices – a forward structure that incentivizes withdrawals from inventory and continued price strength. Milton continued, “Customers that locked in fixed price in 2020 should be loving it; customers that didn’t may be second-guessing why they didn’t. Even now, it’s a worthwhile conversation to have.”

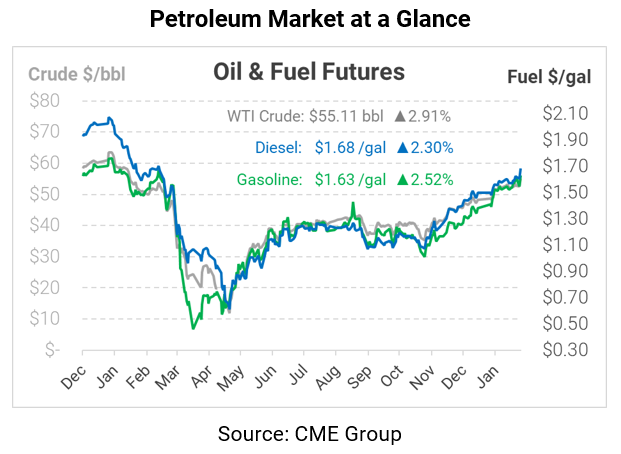

Given the enthusiastic supply news, oil prices are setting new multi-month highs this morning. WTI crude is trading at $55.11, up $1.56 per barrel (2.9%) from Monday’s closing price.

Fuel prices are also setting new highs. Diesel prices are trading at $1.6847, up 3.8 cents (2.3%) since yesterday’s close. Gasoline is trading at $1.6302, up 4 cents (2.5%).

This article is part of Daily Market News & Insights

Tagged: opec

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.