Oil Flat amid Slew of OPEC, Demand, and Political News

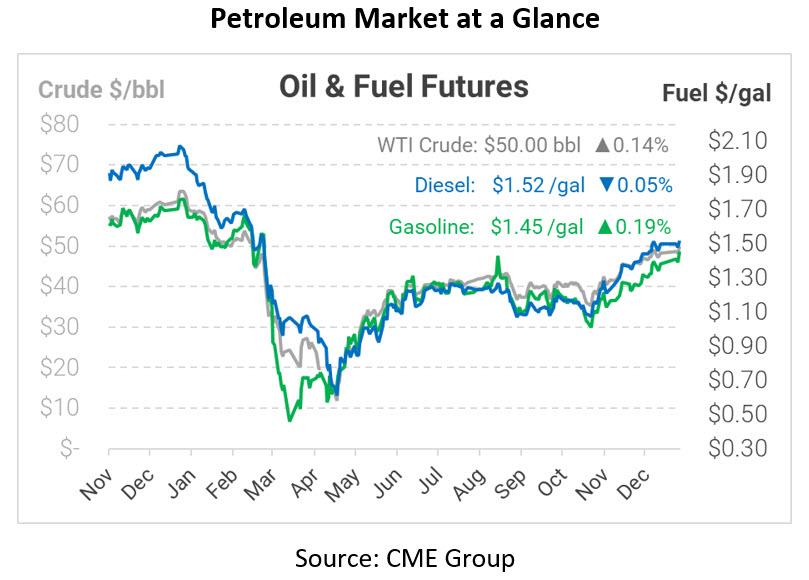

Yesterday, the OPEC+ production agreement continued to surprise markets when Saudi Arabia announced they would voluntarily shoulder an additional 1 MMbpd in cuts. Under the new arrangement, Russia and Kazakhstan will slightly increase their output (by a paltry 75 kbpd) while other producers maintain current cuts. The announcement propelled WTI crude prices briefly above $50/bbl, with markets closing just a few cents shy of the threshold.

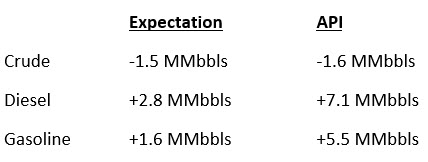

This morning, attention has turned to US markets, where fuel inventories posted much larger builds than anticipated. Although crude managed to eke out a small draw, diesel and gasoline stocks grew by a combined 12.6 million barrels. If the numbers hold true in the EIA’s report later this morning, refiners will feel the pressure to cut back their activity to prevent a collapse in fuel prices. After several weeks of 3:2:1 crack spreads (an indicator of refiner margins) trading above $11/bbl, refiners may not be able to continue raising activity while also increasing their margins.

And of course, political headlines this morning are filled with news from Georgia, where two Senate seats went to a runoff to decide which party controls the Senate. This morning, one seat has been called for Democrat Raphael Warnock, while the other race has yet to be called. Should Democrats win both seats, the incoming president Joe Biden will have control of both houses of Congress, allowing him to enact his agenda more easily. For oil markets, the key policy priorities from a Biden administration are stimulus (increases demand, higher prices), Iran nuclear negotiations (increases supply, lowers prices), and environmental regulation (adds supply costs, raises prices). In the short-term, expect added stimulus legislation to push prices higher, but warming ties with Iran could add 2 MMbpd to global supply markets and cause oil prices to tumble if OPEC+ does not react.

The oil market is trading sideways this morning, with OPEC’s announcement cancelling out the bearish API report. After all, who cares that demand is falling if supply is falling in lock-step? Oil also seems apathetic to recent election results, at least for the short-term. WTI crude oil is trading around $50.00/bbl this morning, barely changed from yesterday’s closing price.

Fuel prices are also struggling to make headway, with markets waiting for confirmation from the EIA report at 10:30am. Diesel is trading at $1.5181, hardly moved from yesterday. Gasoline is at $1.4548, a small gain of 0.3 cents.

This article is part of Daily Market News & Insights

Tagged: Inventories, opec, politics, Saudi Arabia, US Senate

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.