Oil Falls as Coronavirus Cases Surpass 10 MN

Yesterday, WTI crude finished higher, buoyed by some recovery in energy demand. The market saw positive economic news coming out of China over the weekend, with industrial profits in May up 6% from a year earlier, representing the first increase in 2020. In the US, better than expected housing data helped to lift markets on Monday.

Prices are down in early trading this morning. Traders are concerned about the uptick in prices enticing US producers to bring more production back online, which would spoil the recovery. The recovery is also threatened by the possibility of another round of shutdowns as global cases of COVID-19 top 10 million.

The US leads the world with a COVID-19 case tally of 2.55 million and a death toll of 125,803, more than double the 1.34 million cases, and 57,622 deaths recorded in second place Brazil. Within the US, infections have climbed in 32 states over the past 14 days, with California, Texas, and Florida leading the way. Some states are beginning to rollback reopening plans to try to slow down the acceleration of infections. A possible second wave of lockdown measures is spooking markets.

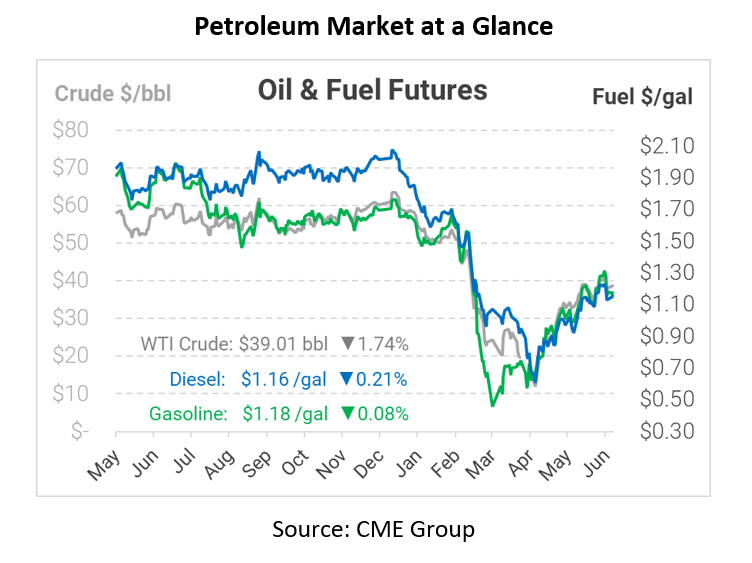

In early trading today, crude prices are down. Crude is currently trading at $39.01, a loss of 69 cents.

Fuel prices are flat this morning. Diesel is trading at $1.1630, a loss of 0.2 cents. Gasoline is trading at $1.1831, a decrease of 0.1 cents.

This article is part of Daily Market News & Insights

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.