Oil Complex Ignoring Bearish News

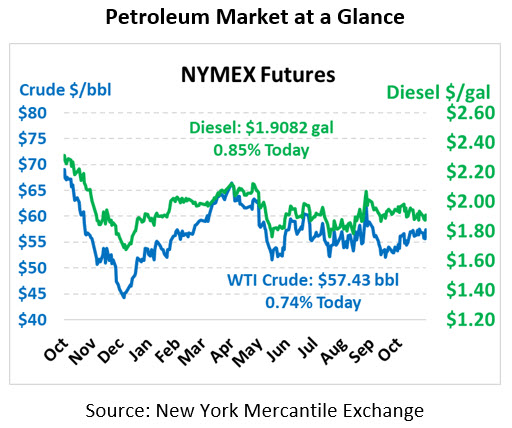

While there was a build in crude stocks reported by the EIA, there was a sizable draw at Cushing which seems to be lifting prices this morning. WTI Crude is trading at $57.43, a gain of 42 cents.

Fuel is up in early trading this morning. Diesel is trading at $1.9082, a gain of 1.6 cents. Gasoline is trading at $1.6573, a fractional gain.

On Wednesday, crude prices rose more than 2% after an announcement from Russia that it would continue its cooperation with OPEC to keep the global oil market balanced. Crude prices are up in early trading today despite OPEC members stating this morning that they likely will not push for deeper cuts at their December meeting and fresh tensions between the US and China over protests in Hong Kong.

President Trump is expected to sign two bills passed by Congress that are intended to support protesters in Hong Kong, potentially delaying “phase one” of a US-China trade deal. The oil complex seems to have ignored bearish news recently and has focused on better-than-expected inventory reports coming from the EIA.

The EIA reported a build for crude of 1.4 MMbbls, in line with the expected build of 1.5 MMbbls. This number, however, was much lower than the API estimate of a 5.9 MMbbls build, and the market seems to be trading on that news. News from Cushing is also likely lifting the market, as stocks fell for the second week in a row with a draw of 2.3 MMbbls, the largest drawdown in three months. The API reported distillates had a larger-than-expected draw and gasoline saw a larger-than-expected build.

This article is part of Crude

Tagged: eia, Hong Kong, opec, President Trump, Russia, US and China, US-China trade deal

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.