Oil Bulls Exiting Market as Coronavirus Surpasses SARS Impact

After another weak session to close out last week’s trading, oil remains lower today amid OPEC+ turmoil. While many had hoped Russia would quickly agree with OPEC’s recommendations for deeper cuts, so far the country has called for a more patient approach. It appears OPEC may not meet until March to discuss production cut extensions, after much of the demand damage has been done. Over the weekend the coronavirus in China exceeded the casualties of SARS back in 2002-03, with 40,000 cases and over 900 casualties. Markets are reacting with low prices, though attempts to push prices below the $50/bbl level have so far been short-lived.

Overall, though, oil traders continue running for the door, which has contributed to the quick decline in oil prices. CFTC data reports on the number of net longs (traders buying) vs shorts (traders selling) in the market. For the NYMEX, managed money net length has fallen significantly. Net length has fallen by more than half since oil prices peaked above $60/bbl earlier this month, taking us to the lowest market length since last fall.

Still, there’s plenty of room for traders to go even more bearish. Back in 2016 when crude sank below $40/bbl, net length was less than half of current levels. As bulls exit the market and give way for a more bearish disposition, it’s possible we’ll see crude oil sink below $50/bbl – though OPEC would be sure to respond with swift action at those levels.

Daily Market Trends

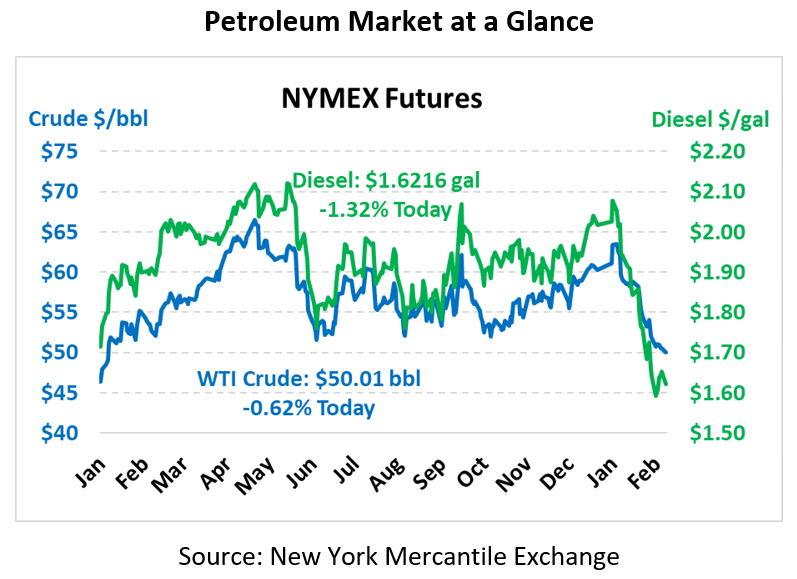

Oil prices continue trading lower today, with several dips below $50/bbl during intraday trading. Crude is currently trading at $50.01, down 31 cents from Friday’s close.

Fuel prices are mixed. Gasoline prices are beginning to rebound as we get closer to spring months, trading at $1.5358, a gain of 1.2 cents. Diesel prices are trading down along with crude at $1.6216, a loss of 2.2 cents.

This article is part of Daily Market News & Insights

Tagged: coronavirus, crude, Daily Market News & Insights, diesel, gasoline

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.