Oil Breaks $90/BBL – What’s Next?

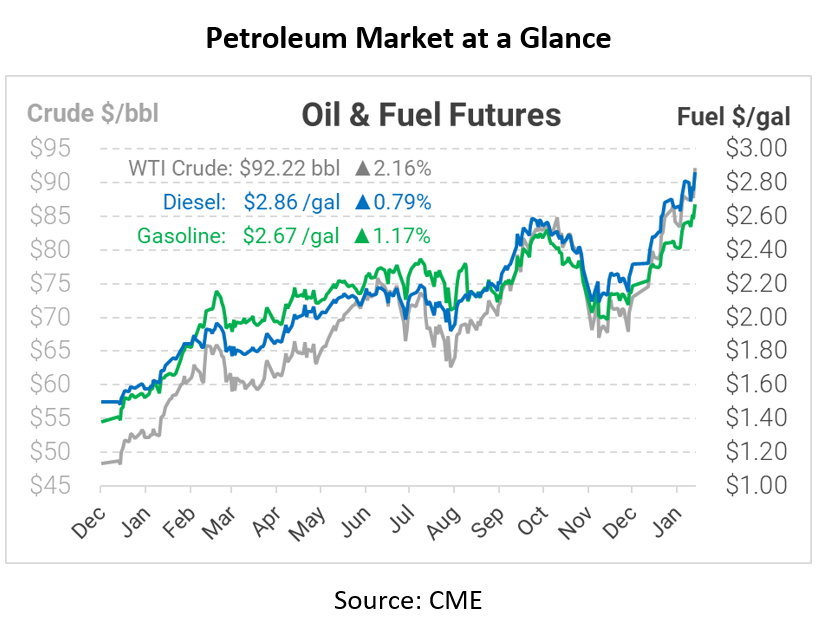

Oil prices just hit yet another major threshold, shattering the $90/bbl cap that’s contained prices since 2014. Oil closed above $90/bbl yesterday, and prices continue rising screechingly higher this morning. The question now is – what’s next?

Crude oil prices have already gained over 20% this year, adding to last year’s hefty upward march. In addition to rising post-COVID demand and supply tightness in the US, Middle East tension and the Russia-Ukraine situation are propelling prices higher. Moreover, a sinking US dollar – which is inversely correlated with commodity prices – is providing tailwinds for the oil rally. Many have pointed to OPEC’s decision to continue with slow production increases as the catalyst for this week’s rally, but in reality many factors are contributing. It’s been seven years since prices were this high, so it’s possible we could see some big swings up and down in the coming weeks as traders get their footing.

Extremely cold weather – both in the US and abroad – are also contributing to record-high demand. The relentless barrage of winter storms in the US has caused power companies to turn to heating oil to supplement natural gas, cranking up demand in northern markets. In New England, heating oil has jumped to 15% of power generation according to hEDGEpoint Global Markets, up from the typical 0-2%. In turn, diesel inventories have fallen to their lowest point in years, and refiners are struggling to keep up. For the East Coast, fuel prices could rise even faster than crude oil in the coming weeks as inventories continue falling.

This article is part of Daily Market News & Insights

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.