No SPR Release – EIA Reports Improving Supply

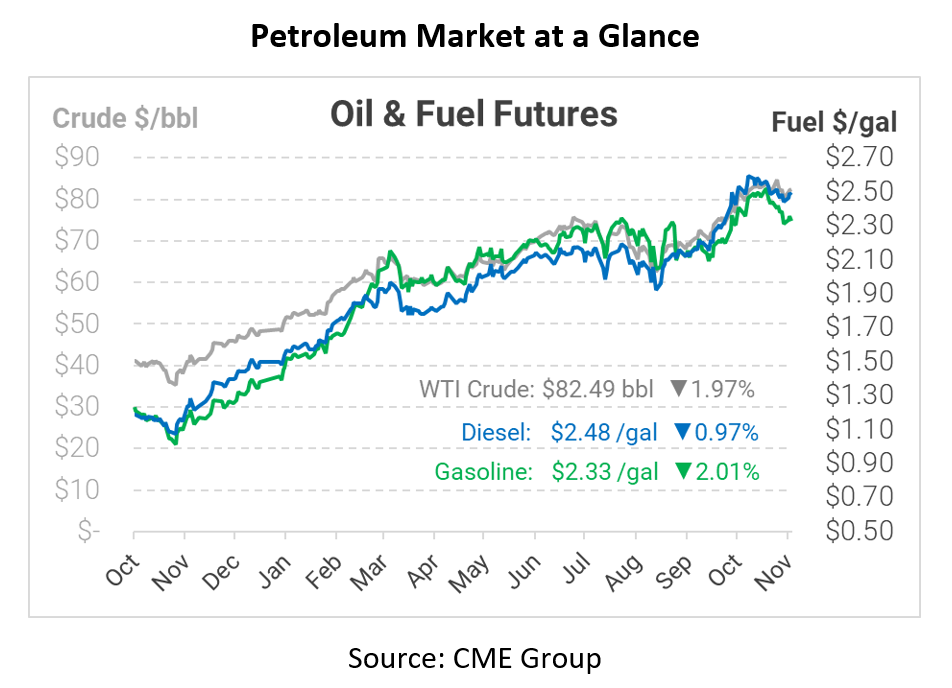

Oil prices exploded higher yesterday, with crude picking up over $2/bbl and fuel rising 4-5 cents per gallon. The White House announced it does not plan to release additional crude oil from the Strategic Petroleum Reserve, leaving markets to handle rising prices on their own. This morning, prices are undoing some of yesterday’s gains thanks to a bearish weekly inventory report.

The EIA released their monthly Short-Term Energy Outlook, which hinted that the future supply gap could be narrowing faster than previously thought. The agency’s report appeared to influence the SPR decision, convincing government officials that an SPR release was not needed. Although the imbalance seems smaller, the only fundamental difference from the last report was a moderate upward revision in US oil production. According to the government agency, oil consumption in October was 98.9 MMbpd worldwide – still 1.9 MMbpd behind October 2019.

Looking at weekly trends, the EIA also published its weekly inventory data this week, showing a moderate build in crude oil along with draws in fuel inventories. As we reported last week, it’s normal to see crude builds during this time of year since refineries are undergoing maintenance and using less fuel. Crude stocks rose by 1 million barrels (MMbbls), while gasoline dropped 1.6 MMbbls and diesel fell 2.6 MMbbls.

This article is part of Daily Market News & Insights

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.