No New Leases on Federal Land – What’s the Impact?

Although equity markets shed 2% yesterday, oil markets remained within their narrow trading range, rising slightly higher to close out the day thanks to a bullish EIA report. Adding to the bullish sentiment is sweeping climate change action taken by President Biden, including an indefinite pause on new leases for oil drilling on federal land.

According to S&P Platts and Rystad Energy, large inventories of leased but untapped land will enable producers to continue producing for decades. The Department of Interior has noted that the oil and gas industry has roughly 7,700 unused drilling permits already approved, and 53% of leased acres are untouched. Federal land, though important for American drillers, isn’t always the best place to drill. During the Trump administration, 78 million acres of offshore federal land were put to auction for drilling, but only 5 million acres were purchased. Rystad estimates the net production impact will be just 250 kbpd of production by 2030. That’s a small fraction of the 1.6 MMbpd of US production that could be impacted if Biden were to completely ban drilling on federal land, considered a “worst-case scenario” for US oil companies. At the signing ceremony, Biden clarified that his action was simply to allow for a strategic review of oil policies, promising “we’re not going to ban fracking.”

The EIA reported its weekly inventory numbers yesterday, showing a huge 9.9 million barrel draw from crude stocks. A big uptick in weekly exports was a major contributor. Exports tend to experience erratic movements based on barge schedules, and last week saw crude exports up 7.7 million barrels week-over-week. Refinery utilization was down by a fraction of a point, but still managed to notch its fourth week in a row trending over 80%. Fuel markets saw mixed inventory movements, with diesel stocks falling slightly while gasoline posted a moderate build.

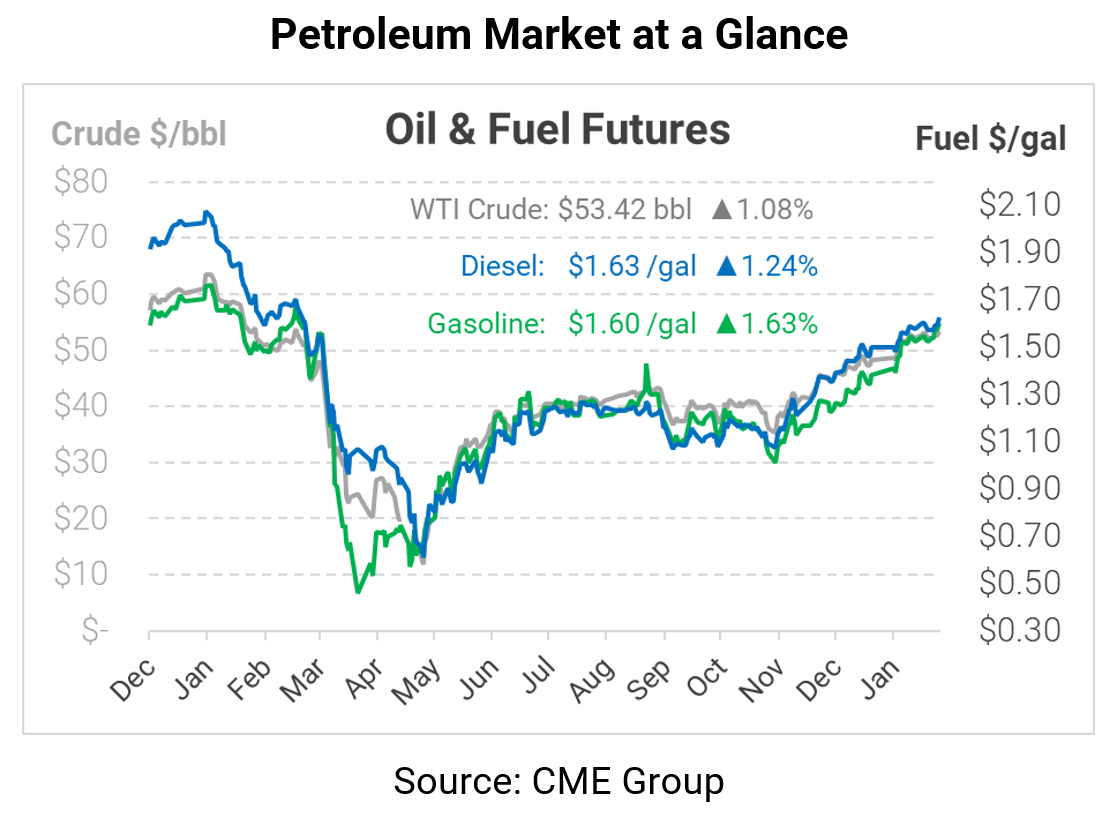

Oil prices are continuing to move higher this morning, supported by the bullish EIA data and slowing COVID cases in the US. Crude oil is trading at $43.42, up 57 cents (1.1%).

Fuel prices are also moving solidly higher, with both gasoline and diesel above $1.60/gal. Gasoline is trading at $1.6028, gaining 2.6 cents (1.6%) from Wednesday’s closing price. Diesel is currently at $1.6289, up 2 cents (1.2%).

This article is part of Daily Market News & Insights

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.