New Multi-Month Highs as Markets Continue Rally

Oil markets are rallying this morning despite an absence of “new” news to provide incremental tailwinds. Indeed, the news may even be considered as a bearish factor, with Tokyo and Quebec each enacting restrictions to curb new COVID-19 cases. But the scale of the news this week has been lifting financial markets across the board, and short-term health challenges are not enough to slow down the frenzy.

Financial markets are rallying on the prospect of a unified Congress and White House passing additional stimulus legislation for the US economy, which would spur consumer activity and support business revenues. Democratic lawmakers, backed recently by President Trump’s call for $2,000 stimulus checks, have long been pushing for higher economic support; with control of Washington, that seems like a highly like outcome. Changing political administrations typically have an impact on fuel prices, though this effect usually stems from alternative fuel policies, environmental regulation, and drilling permitting. Eventually, these factors may again rear their head, but for now the only policy markets are considering is stimulus activity.

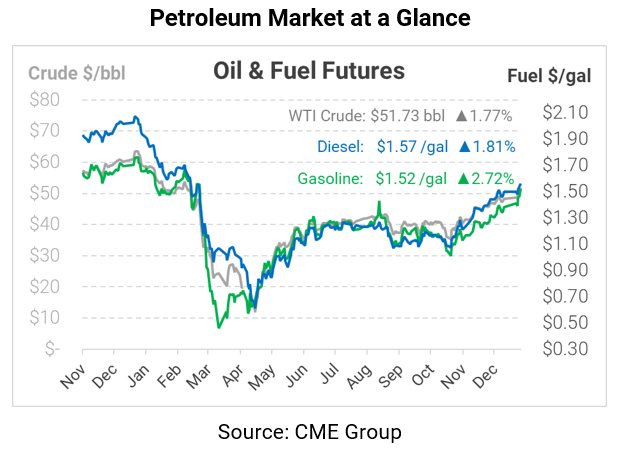

This morning, crude is pushing to new multi-month highs, hitting levels not seen since February 2020 when the world first began worrying about the pandemic. As a reminder, WTI crude was trading just over $60/bbl before the coronavirus took over international dialogue. This morning, WTI crude is trading at $51.73, up 90 cents (1.8%) from yesterday’s closing price.

Fuel prices are also continuing to hit multi-month highs, with gasoline leading the charge. Back when crude was over $60/bbl, diesel prices were trading above $2/gal, while gasoline peaked around $1.75. Fuel prices will need some hefty gains over the next few months to return to that level, but it’s certainly possible that markets will get there. Diesel is trading at $1.5660 this morning, up 2.8 cents (1.8%). Gasoline is trading at $1.5230, up 4.0 cents (+2.7%).

This article is part of Daily Market News & Insights

Tagged: coronavirus, COVID-19, crude, diesel, fuel prices, gasoline, pandemic, Stimulus, Washington

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.