New COVID Strain Spooks Markets

After once again setting a multi-month high on Friday, crude oil is trading steeply lower this morning on news of a new strain of coronavirus in England. The new strain is reportedly up to 70% more transmissible, though scientists have thus far seen no signs that it’s more deadly or will react differently to recently approved vaccines. With new lockdowns imposed and transit halted between England and other EU countries, markets fear a severe hit to oil demand over the winter.

European concerns are overshadowing positive developments in the US, where Congress has agreed to a bipartisan $900 billion stimulus package that will include $600 direct stimulus checks, unemployment funding, an eviction moratorium, funding for vaccine deployment, and small business loans. Congress will vote to pass the legislation today, sending it to President Trump to be signed. Although the stimulus will certainly support fuel demand, traders may point to the lack of state and local funding as a sign that energy demand from state transit systems and infrastructure projects will deteriorate.

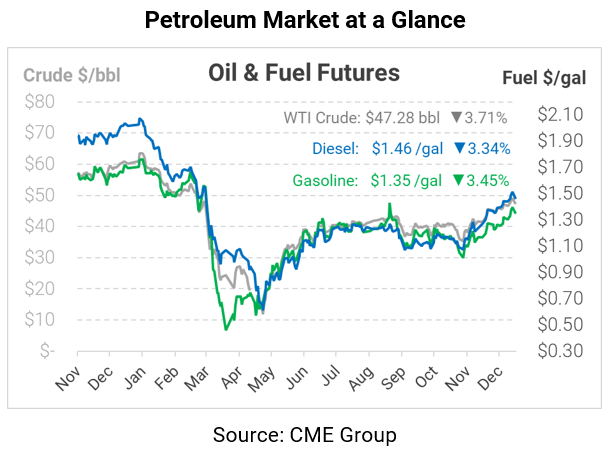

Oil markets are seeing their biggest down day since October, with losses continuing to pile on as the day continues. WTI crude is trading at $47.28, down $1.82 (-3.7%) since Friday’s closing price.

Fuel prices are also seeing heavy losses, though by percentage they’ve performed stronger than crude oil. Diesel is trading at $1.4624 this morning, down 5.1 cents (-3.3%) from Friday’s close. Gasoline is trading at $1.3474, down 4.8 cents (-3.5%).

This article is part of Daily Market News & Insights

Tagged: bipartisan, coronavirus, COVID-19, crude, diesel, gasoline, new lockdowns, new strain, Stimulus, vaccines

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.