Natural Gas News – November 23, 2020

Natural Gas News – November 23, 2020

Climate Targets Could Slash Natural Gas Investment By $1 Trillion

Limiting global warming to 2 degrees Celsius above the temperature in pre-industrial times could mean significantly reduced investments in natural gas supply through 2040, analysts warn. If the world is to go down the 2-degree pathway, investment in new natural gas exploration and production could be slashed by 65 percent, from nearly US$2trillion to US$700 billion, by 2040, because gas demand would peak earlier than previously thought, Wood Mackenzie said in a recent report. While international agencies and supermajors are now competing in calling the date for peak oil demand, talk of peak demand for natural gas is not so mainstream. For more on this story visit wmdt.com or click https://bit.ly/3kSaVte

Why is Natural Gas Trading Up Over 3% Today?

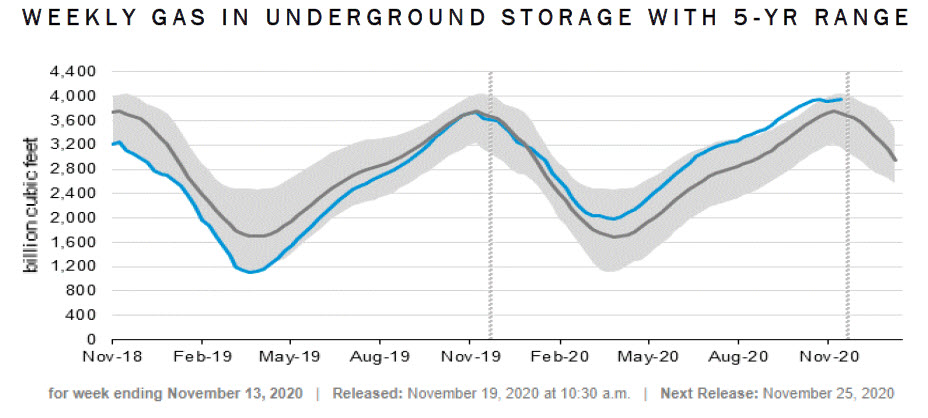

After trading to a high of $3.396 on October 30, December natural gas futures declined to $2.821 per MMBtu. It appears that natural gas inventories peaked at 3.955 trillion cubic feet during the week ending on October 23. Stockpiles do not appear headed over the four tcf level, and the 4.047 tcf peak will remain an untouched record in 2020. The future of US output could be in the hands of Georgia’s voters in January. A runoff election for two seats will determine the majority in the Senate. A pair of victories by the Democrats would replace Mitch McConnel with Chuck Schumer as the majority leader and would hand President-elect Biden clear sailing for his agenda. For more on this story visit bashawstar.com or https://bit.ly/3kOHMPk

This article is part of Daily Natural Gas Newsletter

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.