Natural Gas News – May 21, 2020

Natural Gas Drillers Face Price Meltdown As Storage Fills Fast

Natural gas, the poster child of the fossil fuel industry and the bridge fuel to a renewable future, has suffered its fair share of problems amid the coronavirus pandemic. And it may suffer the same fate as oil, at least when it comes to storage. It may also suffer the same fate with regards to negative prices. For now, natural gas is faring better than oil in terms of prices and loss of demand. According to an analysis from Wood Mackenzie’s Kristy Kramer, Head of Global Gas Market Research, gas demand has fallen by just 2 percent since the start of the crisis, compared with 6 percent for oil. That’s thanks to sustainable demand from several industry sectors, notably power generation and heating. However, prices have plummeted because the outbreak came amid an already oversupplied gas market, pretty much the same as the oil market. Besides, Kramer notes, gas storage was already getting full because of the mild winter. Now it is likely to get fuller. For more on this story visit ENR.com or click https://bit.ly/3g9JbPk

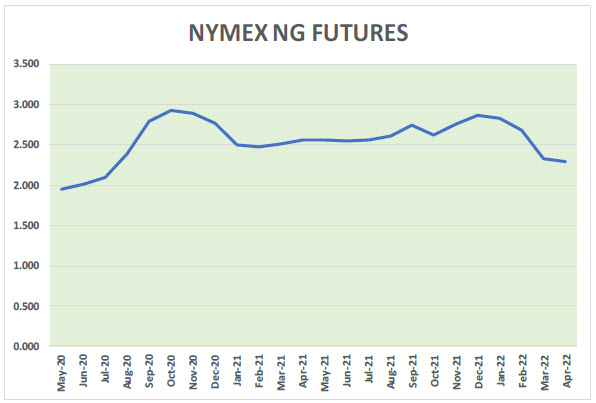

U.S. natgas futures jump over 10% as output slows

U.S. natural gas futures jumped over 10% on Monday on slowing output as energy firms shut wells and slash spending on new oil drilling after crude prices sank earlier this year due to coronavirus-led demand destruction. Those oil wells also produce a lot of gas. Front-month gas futures for June delivery on the New York Mercantile Exchange (NYMEX) rose 17.1 cents, or 10.4%, to $1.817 per million British thermal units at 10:26 a.m. EDT (1426 GMT). That puts the contract on track for its biggest one-day percentage gain since January 2019. Last week, however, gas speculators cut their net long positions on the NYMEX and Intercontinental Exchange for the first time in six weeks as government lockdowns to stop the spread of coronavirus cut energy use, causing fuel prices and exports to drop. U.S. crude futures were still down about 50% since the start of the year, even though prices have gained more than 90% over the past four weeks. much higher than the front-month. For more on this story visit reuters.com or click https://reut.rs/3d39m8k

This article is part of Daily Natural Gas Newsletter

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.