Natural Gas News – July 24, 2017

Natural Gas News – July 24, 2017

Will U.S. Liquefied Natural Gas Find A Market In Asia?

Forbes reports: After 18 months of exporting, some 35% of all U.S. LNG has reached Asia. It’s clear that the Asian giants want to reduce their coal over-reliance by using more natural gas. Moreover, the ability of the Asian giants to produce more of their own gas is in serious doubt. For example, there are great shale opportunities in China, but the future is limited due to water shortages, a pipeline dearth, low prices, physical remoteness of the resource, uncertainties for foreign experts in dealing with China’s precarious state -owned enterprises, and a variety of other factors. China accounts for 7-8% of current global gas demand, but has less than 1% of proven global gas reserves. It is noteworthy, however, that China’s gas production has impressively increased 45% since 2010 to nearly 145 Bcm. The goal in Asia is to create a hub-based trading system that enables countries to rapidly grow their usage of natural gas.

Slide In Crude Oil Undermines Natural Gas Prices, Positioning In Focus

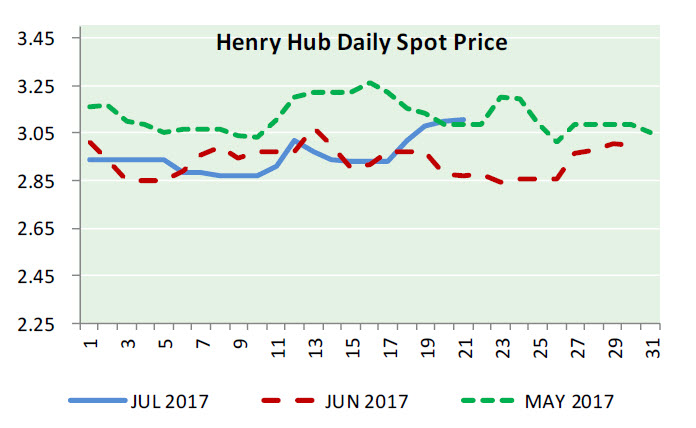

Economic Calendar reports: Natural gas was unable to make any further headway following Thursday’s storage data with an element of profit taking following gains during the week with prices dipping to the $3.02 per mBtu area late in the US session. The dollar remained firmly on the defensive during Friday with the currency index at 11-month lows which provided net support to natural gas prices. With weaker oil prices and a more defensive tone surrounding equity prices, natural gas was unable to gain any traction and drifted to test support just below the $3.00 per mBtu level late in the European session.

This article is part of Daily Natural Gas Newsletter

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.