Natural Gas News – January 9, 2020

Nat Gas News – January 9, 2020

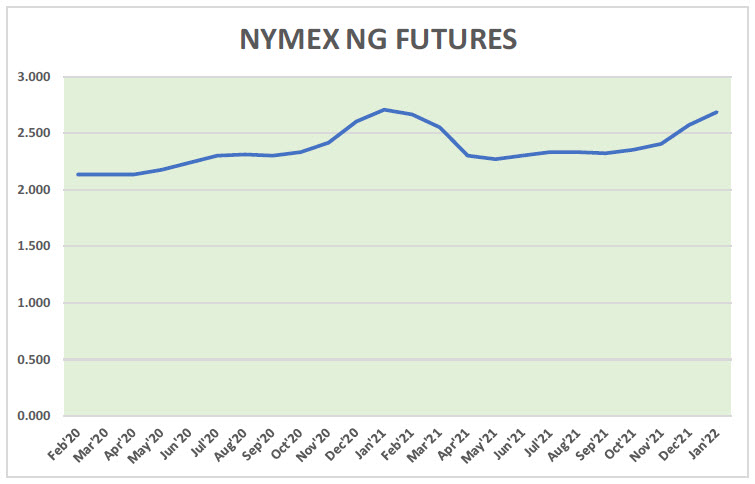

Divergent paths: Oil, natural gas going different directions

Reuters reported: The diverging fundamentals of U.S. oil and natural gas can be seen dramatically in the markets, where the oil-to gas price ratio has surged to its highest in six years. The oil-to gas ratio, or the level at which oil trades compared with natural gas, recently reached 30-to-1, and could increase further as analysts expect average gas prices will fall for a second consecutive year in 2020 to their lowest level in over 20 years. That is because most U.S. drillers are not looking for gas. Companies like EOG Resources Inc (EOG.N), Pioneer Natural Resources Co (PXD.N), Diamondback Energy Inc (FANG.O) and Exxon Mobil Corp (XOM.N) are mostly seeking more valuable oil and natural gas liquids, which bring with it a lot of associated gas, making producers less sensitive to gas price declines. For more on this story visit reuters.

com or click https://reut.rs/36Qa9GA

Average U.S. Natural Gas Prices Hit Three-Year Low In 2019

Oil Price reports: Due to continuously rising U.S. natural gas production, natural gas prices at the U.S. benchmark Henry Hub averaged US$2.57 per million British thermal units (MMBtu) in 2019—the lowest annual average price since 2016, the U.S. Energy Information Administration (EIA) said on Thursday. The average natural gas price last year was US$0.60 lower than the average Henry Hub price in 2018. Monthly average prices at the key U.S. regional trading hubs hit their highest in February 2019, due to the winter season, and then they were relatively stable and low from April to December, the EIA has estimated. New pipelines to carry the growing volumes of natural gas out of the Permian partially eased the takeaway capacity constraints and pushed natural gas prices at the Waha hub in Texas higher in the latter part

of the year, after six months in a row of average monthly prices lower than US$1/MMBtu—March through August. In early April 2019, prices at the Waha hub plummeted to record low negative levels, as pipeline constraints and problems at compressor stations at one pipeline stranded gas produced in the Permian. For more on this story visit oilprice.com or click https://bit.ly/2FFHKXP

This article is part of Daily Natural Gas Newsletter

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.