Natural Gas News – February 8, 2022

Natural Gas News – February 8, 2022

The Global Gas Crisis Has Made American LNG Hot Again

The global gas crunch and skyrocketing prices in Europe and Asia are laying the foundations for a revival in final investment decisions in new liquefied natural gas (LNG) export projects in the United States. Following a nearly three-year-long hiatus in project sanctioning in

America, the high natural gas prices globally, the historically low storage levels in Europe, and the continuously growing gas demand in Asia could incentivize the signing of more long-term offtake LNG contracts. Such deals would secure supply commitments for decades for LNG projects and show financiers that export facility developers could make handsome profits by selling gas to energy-starved regions, despite the recent backlash against fossil fuels, including natural gas. Several U.S. LNG projects hope to move to final investment decision… For more info go to https://bit.ly/3shaoqa

U.S. Natural Gas Market: Production Drops, Consumption Rises

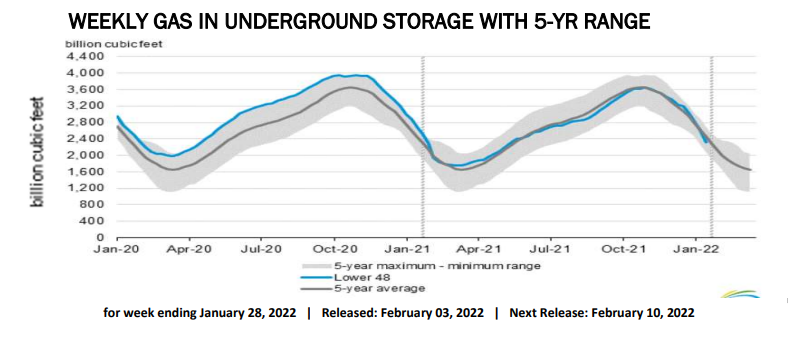

Last week (ending Jan. 28), the number of heating degree days (HDDs) increased by 5% w-o-w (from 218 to 230). The total “energy demand” (as measured in total degree days or TDDs) was 12% above last year’s level and as much as 18% above the 30-year average. This week (ending Feb.4), the weather conditions in the contiguous United States have been warming up. I estimate that the number of nationwide HDDs will drop by 9% w-o-w (from 230 to 210). The average daily consumption of natural gas (in the contiguous United States) should be somewhere between 113 bcf/d and 116 bcf/d. The total “energy demand” (measured in TDDs) should increase by 12% y-o-y, while the deviation from the norm will moderate but will remain positive (+9.8%). Next week (ending Feb.1), the weather conditions are currently expected to warm up. In … For more info go to https://bit.ly/3GoVN0Y

This article is part of Daily Natural Gas Newsletter

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.