Natural Gas News – December 5, 2018

Natural Gas News – December 5, 2018

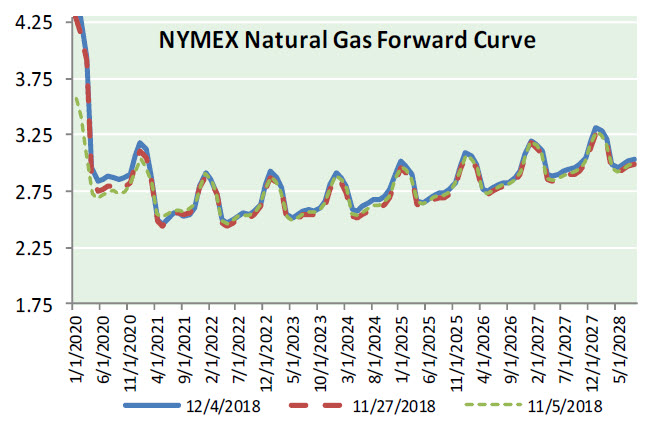

Overseas Markets Should Help Cap U.S. Natural Gas Prices

Forbes reported: Current plans calling for the construction of as much as 18 bcf/d of capacity in the next few years should be interpreted cautiously; recall that in 2003, 5.3 bcf/d of import capacity was planned given long-term expectations of tight U.S. gas markets and continued high prices. As the figure below shows, LNG imports never reached more than a fraction of that level, and the country is now a net exporter. Most plants were never built though some were later converted to export facilities. Could there be a new boom and bust cycle in LNG exports? Quite possibly. At present, 8 bcf/d of capacity is under construction, and another 8 bcf/d is approved but not under construction (as of late October). If all were built and operated, they would absorb a fifth or more of current domestic gas production levels. Already, this appears, in combination with cold weather, to have raised prices in the U.S. For more on this story visit forbes.com or click https://bit.ly/2PknSvZ

OPEC Oil Decision Could Undercut U.S. Natural Gas Price Surge

Bloomberg reported: A decision by OPEC and its allies to cut oil output in order to bolster prices could, in an odd market twist, undermine a recent price surge for natural gas heading into winter. For most of 2018, gas prices sat in a narrow trading range significantly below the five-year average. In November, though, prices surged as much as 41 percent as frigid weather stoked concerns about supply shortages ahead. The Economic Commission Board for the global oil cartel and its partners will meet Dec. 6 in Vienna to decide whether to curb crude output to help raise oil prices that have fallen by more than 30 percent in the last two months. If the 15-nation group approves limits, it could give U.S. shale drillers added revenue to boost their output of both oil and the gas that’s pumped up alongside it. The more gas, the lower the price. “The OPEC decision will definitely matter,” said Jane Trotsenko, an analyst with Stifel Nicolaus & Co. Inc., in a telephone interview. For more on this story visit bloomberg.com or click https://bloom.bg/2KWCkd3

This article is part of Daily Natural Gas Newsletter

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.