Natural Gas News – August 25, 2022

Natural Gas News – August 25, 2022

Firms make deals to boost LNG exports 60% from U.S., Canada, Mexico

North American liquefied natural gas (LNG) developers and producers this year have struck deals to sell 48 million tonnes of LNG, which will eventually pump up exports 60% from current levels, although much of the output remains years away. LNG demand is soaring as the conflict in Ukraine pushes global prices to their highest in at least 14 years. Buyers in Europe have looked West in a move away from Russian gas, and Chinese buyers are striking long-term deals after a pause. New gas-export plants are being developed across the United States, and Mexico and Canada are poised to join as significant gas exporters, with plants proposed for their west coasts. read more Eight North American LNG export terminals are under construction and over a dozen more could receive financial greenlights by 2023. Some buyers have… For more info go to https://reut.rs/3AJlB8z

U.S. Natural Gas Jumps To $10 For The First Time Since 2008

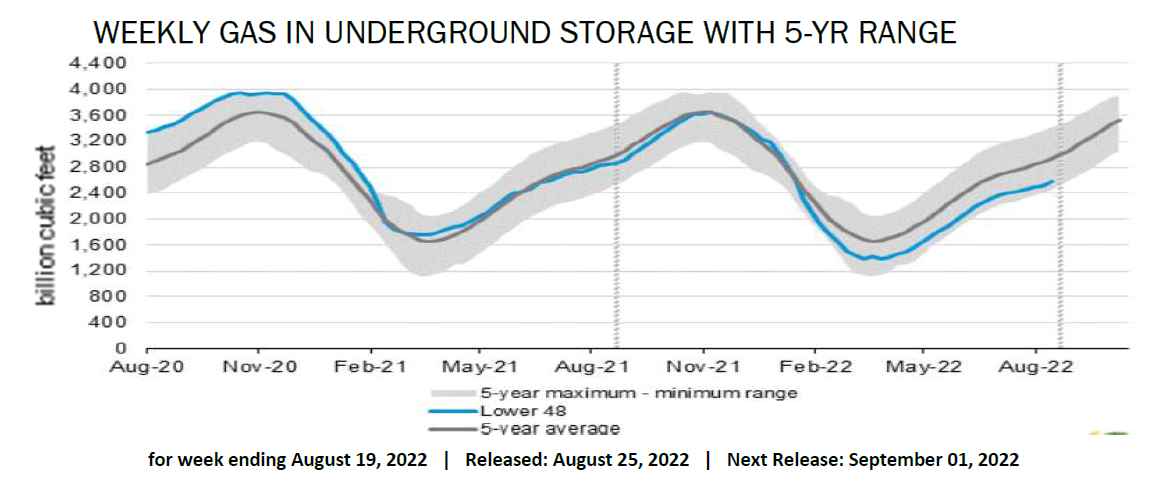

U.S. natural gas futures hit $10 per million British thermal units (MMBtu) early on Tuesday, jumping briefly above that threshold for the first time since 2008 as the energy crisis in Europe is worsening, and EU gas prices surged to another record today. As of 8:43 a.m. ET, the front-month U.S. benchmark natural gas price at Henry Hub was up by 0.60% at $9.737/MMBtu, having hit $10/MMBtu earlier in the day. U.S. natural gas prices have soared in recent weeks as Europe scours the world for non-Russian gas supply—mostly U.S. LNG—to fill gas storage sites in time for the winter heating season. After a slump in early June due to the Freeport LNG force majeure, U.S. benchmark gas prices have rallied by 70% since the end of June, hitting last week their highest level since August 2008 at above … For more info go to https://reut.rs/3AJlB8z

This article is part of Daily Natural Gas Newsletter

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.