Nat Gas News – May 17, 2017

Nat Gas News – May 17, 2017

In the News

New deal allows U.S. to sell tons of natural gas to China

The National Interset reports: The U.S. and China recently agreed to a major liquid natural gas (LNG) trade deal, which could generate $26 billion annually for America. The Department of Commerce announced a 100-day action plan to allow Chinese companies to negotiate long-term contracts from American suppliers. The energy firm Wood Mackenzie estimates this deal could pump $26 billion into the U.S. economy each year by 2030. China is now the largest foreign buyer of U.S. oil, according to new data from the U.S. Energy Information Administration. U.S. crude oil exports in February jumped 35 percent as China started buying American oil. The country surpassed the U.S. as the world’s largest net importer of petroleum in 2013. China’s own fracking revolution stalled due to the poor quality of its shale reserves. Though China’s shale reserves are large, they are prohibitively expensive and technically difficult to extract, being economically recoverable at a shockingly high $345 a barrel. For more on this story visit nationalinterest.org or click http://bit.ly/2pFYlWg

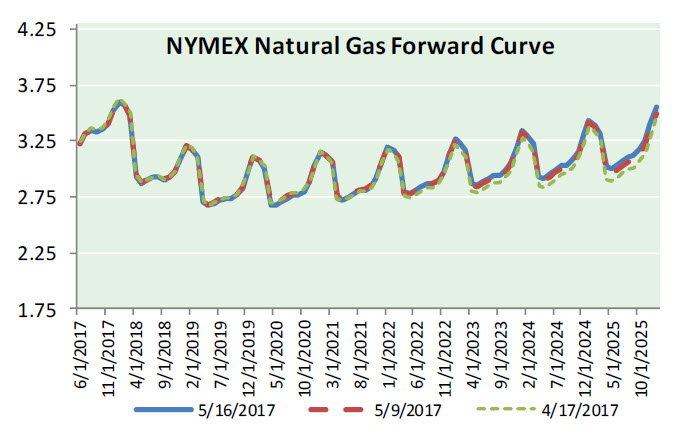

U.S. natural gas futures tumble for 2nd straight day

Investing. com reports: U.S. natural gas futures were under pressure for the second day in a row on Tuesday, falling close to a one-week low after the latest U.S. weather model called for mild temperatures over the next two weeks, which should reduce demand during that time. Natural gas prices have closely tracked weather forecasts in recent weeks, as traders try to gauge the impact of shifting outlooks on spring heating demand. Meanwhile, market participants looked ahead to weekly storage data due on Thursday, which is expected to show a build in a range between 55 and 63 billion cubic feet in the week ended May 12. That compares with a gain of 45 billion cubic feet in the preceding week, an increase of 73 billion a year earlier and a five-year average rise of 87 billion cubic feet. For more on this story visit investing.com or click http://bit.ly/2pTE2jP

This article is part of Daily Natural Gas Newsletter

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.