Nat Gas News – March 25, 2020

US natural gas in storage enters its final week of withdrawal season as demand wanes

S&P Global: A survey of analysts expect a weaker-than-normal draw from working gas in storage last week, as only one more net pull likely remains before the switch to injections, with demand muted more than usual during the upcoming shoulder season. The US Energy Information Administration is expected to report a 27 Bcf withdrawal for the week ended March 20, according to a survey of analysts by S&P Global Platts. Responses to the survey ranged from draws of 21 Bcf to 35 Bcf. The EIA plans to release its weekly storage report at 10:30 ET Thursday. A 27 Bcf withdrawal would be much less than the 39 Bcf pulled in the corresponding week last year as well as the five-year average draw of 40 Bcf. A withdrawal within expectations would decrease stocks to 2.007 Tcf. The surplus to the five-year average would expand to 294 Bcf, and the overhang to 2019 would increase to 890 Bcf. For more on this story visit spglobal.com or click https://bit.ly/33K28Cw

Amid Oil Price Crash, Natural Gas Is Also Under Attack

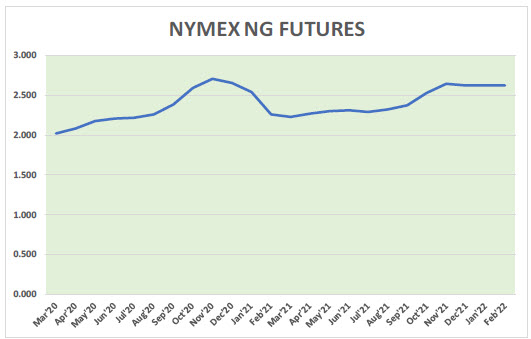

Hellenic Shipping News reports: The big news related to the oil and gas business over the past few weeks has obviously been related to the crash in oil prices. First, the global demand destruction by the spread of the coronavirus knocked the price for West Texas Intermediate down below $45/bbl, and then the joint decision by Russia and Saudi Arabia to flood the markets with cheap crude shattered it down into the low-$20s. No one knows where this might end – some even think the price could go negative as global crude storage capacity becomes completely full. Mostly forgotten amid all of this distressing oil-related news has been the fact that U.S. natural gas prices had already become depressed last year, with the NYMEX price falling below the $2 per MMBtu level before anyone had ever heard of the coronavirus. This was due both to a situation of chronic over-supply that has persisted for half a decade, and to the decision by the anti-fossil fuel lobby and the policymakers they influence to conduct a policy-related war on natural gas beginning a couple of years ago. For more on this story visit hellenicshippingnews.com or click https://bit.ly/2xl9C2T

This article is part of Daily Natural Gas Newsletter

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.