Nat Gas News – June 27, 2017

Nat Gas News – June 27, 2017

Lithuania signs first deal for U.S. LNG

Reuters reports: Lithuania’s state-owned gas trader Lietuvos Duju Tiekimas (LDT) said on Monday it had signed a deal to buy liquefied natural gas (LNG) directly from the United States for the first time and expects to receive a delivery in the second half of August. The deal is with a unit of Cheniere Energy and is part Lithuania’s efforts to diversify its gas suppliers and reduce its reliance on Russia’s Gazprom. LDT, part of state-owned energy group Lietuvos Energija, signed a deal last year with Koch Supply & Trading for LNG supplies throughout 2017. The LNG terminal at the Klaipeda port broke Russia’s Gazprom gas supply monopoly in the Baltic States when it came online in 2014 and now provides Lithuania with roughly half of its gas. Lithuania will store the LNG gas at its Incukalns underground gas storage, LDT said.

U.S. natural gas futures kick off the week with strong gains

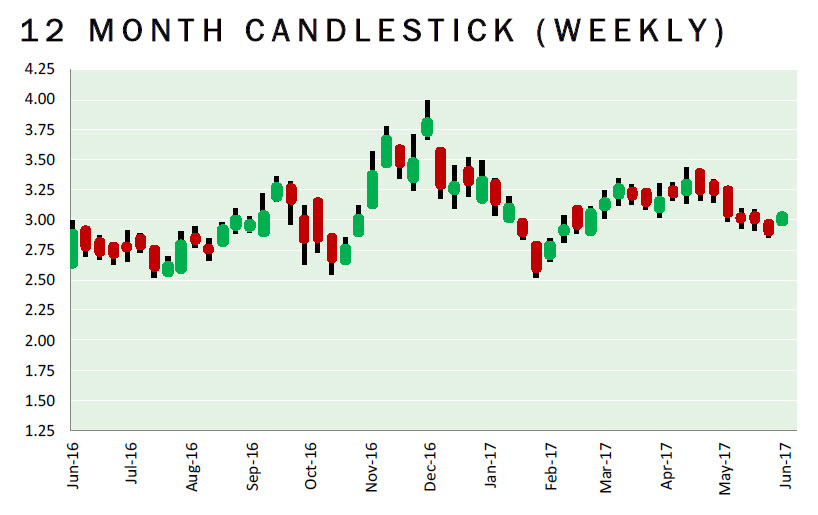

Investing.com reports: U.S. natural gas futures started the week with strong gains on Monday, extending their recovery from three -month lows as updated weather forecasting models pointed to increased summer demand in the weeks ahead. U.S. natural gas for August delivery was at $2.997 per million British thermal units by 8:40AM ET (1240GMT), up 4.6 cents, or around 1.6%. It fell to its lowest since March 8 at $2.875 on Thursday of last week. Market participants looked ahead to weekly storage data due on Thursday, which is expected to show a build in a range between 50 and 61 billion cubic feet in the week ended June 23. That compares with a gain of 61 billion cubic feet in the preceding week, an increase of 37 billion a year earlier and a five-year average rise of 72 billion cubic feet.

This article is part of Daily Natural Gas Newsletter

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.