Nat Gas News – July 18, 2017

Nat Gas News – July 18, 2017

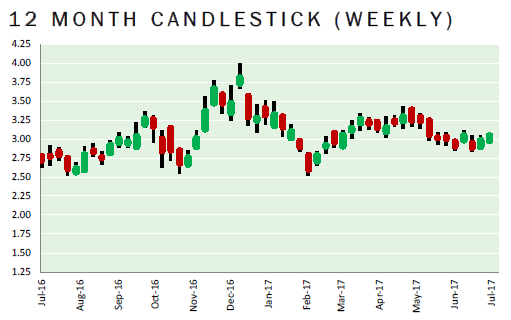

Demand Boost Helps Strengthen Natural Gas Prices, Traders Increase Long Position

Economic Calendar reports: Natural gas prices consolidated just below the $3.00 per Mbtu level in late US trading on Friday with net gains on Monday as elevated temperatures continued to boost demand. The latest NYMEX data record-ed an increase in the long, non-commercial positions in the latest week with net longs above 92,500 from just below 81,000 the previous week. This was the second successive weekly increase and highest positioning for four weeks. The dollar remained on the defensive during Monday with the US currency index held below the 95.0 level. Underlying US vulnerability continued to provide net support for energy prices during the day. The latest weather forecasts suggest that very hot conditions will prevail across most of the country during the week ahead even if there is some slight relief from very high temperatures during next weekend.

Oil and gas officials are confident in the industry’s bright future

The Exponent Telegram reports: Oil and gas officials continue to be optimistic about the industry’s future in West Virginia. Scott Freshwater, president of the Independent Oil and Gas Association of West Virginia, said although the price of natural gas in the Appalachian basin is discounted right now because there’s such an oversupply, there are factors that could boost the price. With projects such as Dominion’s Atlantic Coast Pipeline and EQT’s Mountain Valley Pipeline in the works, Freshwater said industry officials hope to soon see the current transportation bottleneck reduced or eliminated, which would allow the region’s abundant supply of natural gas to reach markets on the East Coast.

This article is part of Daily Natural Gas Newsletter

Tagged: nat gas

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.