In the News

U.S. natural gas production will increase in 2017

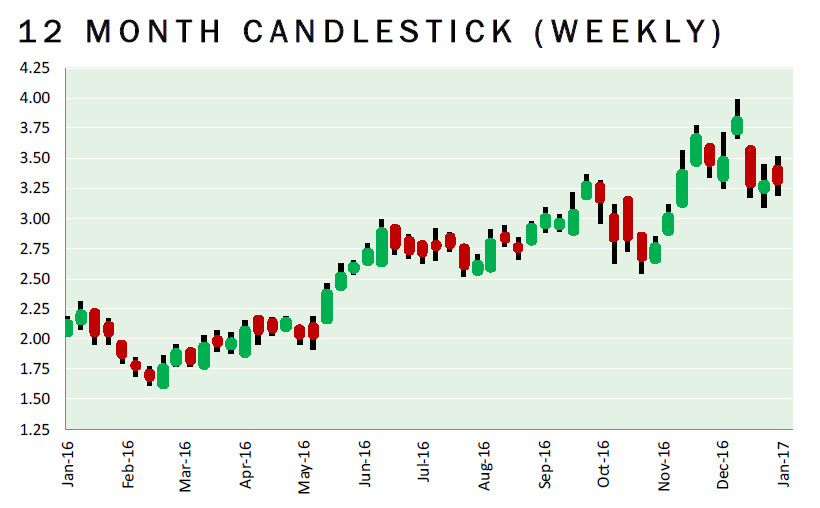

Forbes reports: After the first fall in U.S. dry gas production in more than

a decade in 2016, output is sure to regain its upward trend in 2017. No wonder, EIA has Henry Hub prices increasing from $2.50/MMBtu last year to nearly $3.30 this year. Again, regardless of what some keep telling you, we have baseload gas demand markets that are continually growing: gas for electricity, gas for industrial use, gas for LNG export to the world, gas for piped export to Mexico and Canada. And don’t underestimate emerging idiosyncratic uses, such as gas in heavy trucking and gas as the required backup for wind and solar power. Let’s be perfectly clear, following “the California model,” as environmental groups and President Obama’s EPA want us to, has a known bottom line: more renewables ultimately mean more natural gas. For more visit

forbes.com or click

http://bit.ly/2jQ5EqwMild weather weighs on natural gas price

Economic Calendar reports: Natural gas prices ended the week on a down note, with the contract for February settlement on the New York Mercantile Exchange closing today’s pit session $0.16 lower, or down 4.8%, at 3.21/MMBtu. In today’s trading, the focus was shifted to the forecast for unseasonably mild temperatures over the near term, which will likely weigh on demand for natural gas. In February, temperatures are expected to cool, which could help the commodity. With Friday’s move to the downside a new low for the week was established at $3.189 and the contract broke below the 61.8% retracement level of the advance from the January 9th low, thereby increasing the probabilities of a move to retest this low, at $3.098, in next week’s trading. The bias in natural gas, however, remained to the downside despite Thursday’s rebound, as open interest was not supportive during the rally from the January low. Natural gas prices have been volatile in recent weeks due to changing weather forecasts. For more on this story visit

economiccalendar.com.