Nat Gas News – April 25, 2017

Nat Gas News – April 25, 2017

In the News

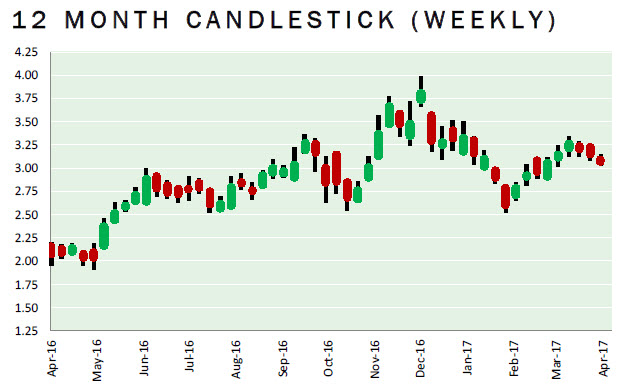

U.S. natural gas futures edge lower

Investing.com reports: U.S. natural gas futures edged lower for the third straight session on Monday, as traders monitored shifting weather forecasts to assess the outlook for early-spring demand and supply levels. Weather systems will impact the Southeast and Northern parts of the U.S. during the next few days, with showers and cooling combining to drive slightly stronger than normal demand. As the week progresses, warm high pressure will build over the East with highs of 70s to upper 80s, driving modest early season demand for cooling. For more visit investing.com or click the following link http://bit.ly/2op09Co

Chevron to sell Bangladesh gas fields to Chinese consortium

Reuters reports: Chevron Corp is selling its three Bangladesh gas fields, worth an estimated $2 billion, to a Chinese consortium as the U.S. oil and gas group looks to shed non-core assets this year. The deal, if completed, would mark China’s first major energy investment in the South Asian country, where Beijing is pumping in billions of dollars in a race with New Delhi and Tokyo for influence. The gas fields, which account for more than half of the total gas output in Bangladesh, are being sold to Himalaya Energy, Chevron said. Himalaya is owned by a consortium comprising state-owned China ZhenHua Oil and investment firm CNIC Corp. Chevron sells its entire output from the Bangladesh fields — 16 million tons a year of oil equivalent — to state oil company Petrobangla under a production-sharing contract. The Bangladesh government has the right of first refusal in any asset sale. Bangladesh’s junior minister for power and energy, Nasrul Hamid, said that energy consultant Wood Mackenzie is still evaluating whether it would be profitable for the country to make a bid. For more on this story visit oilprice.com or click the following link http://reut.rs/2oEypVq

This article is part of Daily Natural Gas Newsletter

Tagged: natural gas, prices

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.