Most Profitable Company in the World: Saudi Aramco

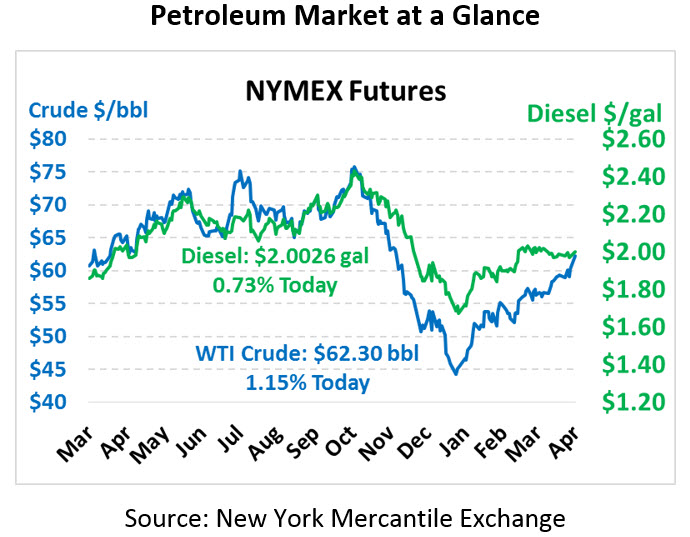

We hope you enjoyed our April FOOLSNews report yesterday. While Venezuela is not closed and the world is not ending, in all seriousness, yesterday did bring sizable gains to crude markets, though fuel prices remained relatively flat. Crude picked up almost $1.50 yesterday, largely driven by positive economic data from China and “candid and constructive” US-China data. This morning crude is trading at $62.30, up 70 cents and the highest level since 2018.

Fuel prices are also turning higher this morning after meager gains yesterday. Diesel saw the largest gains yesterday, up 1.5 cents compared to gasoline’s 0.3 cent gains. This morning, diesel is trading at $2.0026, up 1.5 cents once again. Gasoline prices are trading at $1.9109, up 1.2 cents.

AS we approach expiration of Iran sanction waivers in May, markets are getting antsy to see how the State Department will handle renewals. Countries have been slowly increasing their Iranian imports, which rose to an estimated 1.3 MMbpd in March, to stash away excess crude before sanctions are re-imposed. Increased Iranian output is helping to offset declining Venezuelan output, which reportedly fell below 0.7 MMbpd in March while exports to the US hit zero for the first time on record.

OPEC+ countries are beginning to get serious about meeting their commitments, with Russia and Kazakhstan both in compliance with the deal. Saudi Arabia has been going above and beyond their production cuts, balancing the market faster than anticipated. Libya, on the other hand, has seen production rise as their El-Sharara field is back in production and instability has recently been contained. Of course, Libya is one of the most unstable producers, so there’s littler guarantee their increase in production holds.

Saudi Aramco, Saudi Arabia’s state-owned oil company, recently gave investors the opportunity to see into their financials, which showed the most profitable company in the world – well ahead of US majors such as ExxonMobil or Apple. Saudi Aramco is issuing bonds to raise funds for a $69 billion acquisition of Saudi petrochemical company Sabic, providing more downstream integration. Proceeds from the sale of Sabic, currently owned by the Saudi Sovereign Wealth Fund, will fund Saudi Crown Prince Mohammed bin Salman’s plan to diversify the Saudi economy away from oil. One notable takeaway from the financial review – although Saudi Arabia has some of the cheapest oil in the world in terms of extraction costs, other leading oil companies such as Shell can achieve higher profits per barrel due to heavy taxes on Aramco from the Saudi government.

This article is part of Crude

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.