More Volatility from Suez Canal, OPEC Meeting, and COVID

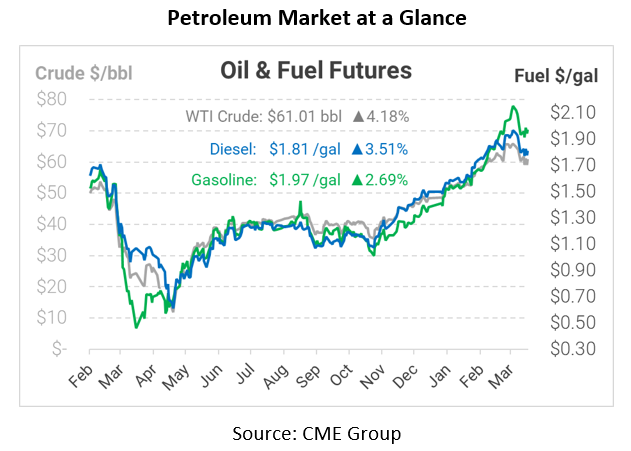

Oil price volatility continues this week, with huge up-and-down movements for oil prices each day. Yesterday, oil prices once again plummeted, approaching Tuesday’s low closing level. Some of the volatility is driven by the Suez Canal blockage. There are ships on both sides trying to pass through, and a surprise tanker delivery (or a decision not to load a tanker) can suddenly shift oil inventories. If the blockade does take weeks to mend, as some are projecting, it would force oil tankers to commute around Africa to complete deliveries – adding time and cost into the oil supply chain.

Next week, OPEC is meeting to review its commitment to cutting oil production. Given the recent wave of selling, most market participants expect the group to stay the course with existing cuts, rather than increasing their output. When the group signed their agreement early last year, the plan was to limit 2021 cuts to just 5.7 MMbpd; instead, cuts have held at 7.2 MMbpd, with Saudi Arabia contributing even more. Those cuts have kept a solid floor beneath oil prices despite plenty of demand concerns. If OPEC stays the course, it would reassure markets that the oil rally is still possible. If they increase production, we could see markets give up hope of a rally and turn lower, at least for a while.

Mounting COVID cases worldwide also gave the market pause yesterday. Although the US has seen a huge improvement in case counts and daily deaths, the global totals are moving in the opposite direction. The longer the pandemic rages, the greater the risk that a variant strain might prove more transmissible or vaccine-resistant.

This article is part of Daily Market News & Insights

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.