Modest Rally Brewing in the Shadow of Slowing Oil Demand

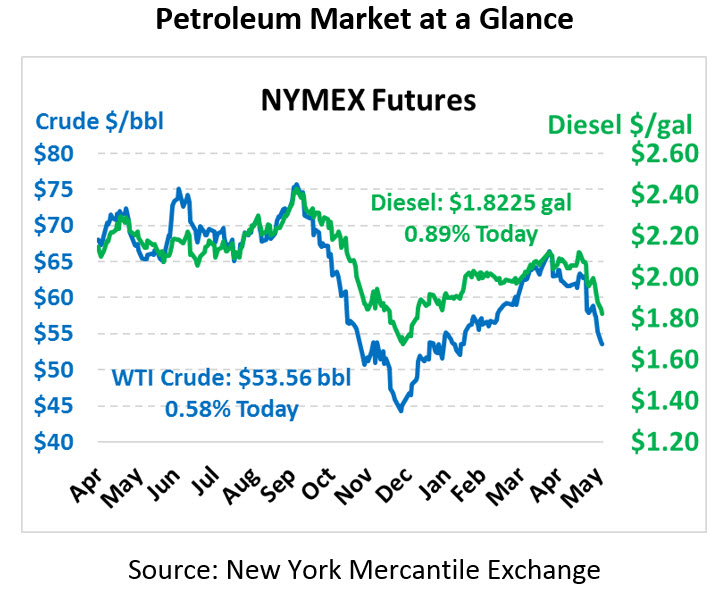

A modest rally is brewing as the specter of a slowing global economy and slowing oil demand continue to loom. Crude is currently trading at $53.56, a gain of 31 cents.

Fuel prices are mixed. Diesel is following crude trading at $1.8225, up 1.6 cents. Gasoline is trading lower at $1.7226, a loss of 1.9 cents.

In the wake of a trade war with China and possibly Mexico sentiment among investors appears to show weakness in the market with few new bullish signs. Investors are shying away from energy markets as volatility in the market is difficult to get a handle on. The most recent round of sell-offs was prompted by Trump’s tweets threatening tariffs on Mexico if they did not address illegal immigration flowing from their country to the United States. The threat did not, however, clearly lay out what Mexico could do to stop the tariffs from going into effect.

On the supply front, OPEC+ is trying to talk up the market by saying that a consensus is forming for production cuts in the second half of the year. A proposal to move the OPEC+ meeting to July has been met with some resistance from Iran and some other members who wish to meet on schedule at the end of June. Due to recent market movement and fall in prices, OPEC+ wants to tread lightly around raising production which could create an oversupply situation and a possibly precipitous price drop.

In fuels news, slumping demand has ushered in lower prices. Recent storms in the Midwest have negatively affected diesel demand which had already been suffering from the slow start to the planting season. Diesel is down for the week, but we are seeing a small rally today. In addition, gasoline demand which had been strong for some time is showing signs of weakness after a surprise drop in demand last week.

This article is part of Crude

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.