Moderna Vaccine Boasts 95% Efficacy, Easier Logistics

Financial markets are soaring this morning on news that a second COVID-19 vaccine, manufactured by Moderna, is 94.5% effective in preventing infections. Recently, Pfizer announced their treatment was 90% effective. Typical vaccines such as the flu vaccine are just 40-60% effective, so high efficacy suggests better results once vaccines are approved and deployed.

The Pfizer vaccine faced a daunting distribution challenge – the drug must remain at -70⁰ Celsius until being administered. The Moderna vaccine, on the other hand, can last six months at -20⁰ C and up to a month in normal refrigerator conditions (just above freezing). Easier distribution logistics may ultimately win the day – although Pfizer was first, Moderna will be much easier for the medical supply chain to accommodate.

The second vaccine was not the only supportive news this morning. In China, refining data shows the highest throughput levels since June 2020, which in turn was the highest level since 2012. Before the pandemic, China was one of the world’s largest oil importers, sucking up supply to feed its growing population and fill its strategic reserves. That trend seems to be continuing now, with the past several months showing elevated refining activity.

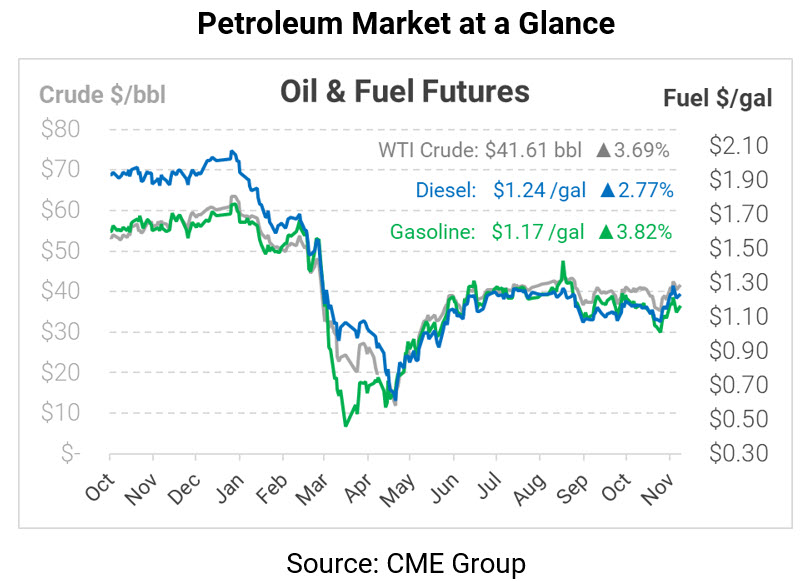

Crude prices are moving higher this morning, along with other financial markets. Crude oil is trading at $41.61, a gain of $1.48 (+3.7%) since Friday’s closing price.

Fuel is also moving upward, though diesel’s gains are lagging the market. Diesel prices are $1.2376, up 3.3 cents (+2.8%). The smaller gains are likely attributable to large gains seen over the past few weeks for the product. Gasoline is trading at $1.1684, up 4.3 cents (+3.8%).

This article is part of Daily Market News & Insights

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.