Midwest Flooding Disrupts Ethanol, Causes Gasoline Volatility

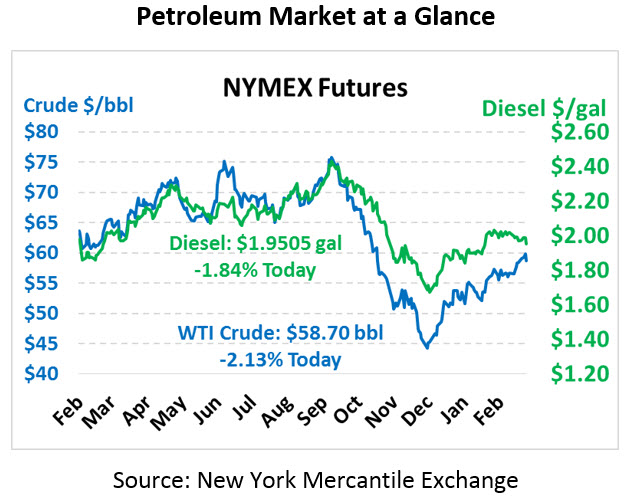

Oil is heading lower today amid profit taking as traders cash in on recent highs in the market. Crude oil is trading at $58.70, down $1.28.

Fuel prices are also taking a turn lower, with diesel reacting strongly to negative economic news while gasoline remains relatively stronger. Diesel prices are currently $1.9505, down 3.7 cents from yesterday’s close. Gasoline prices are trading at $1.9044, a 1.6 cents decline.

The US Dollar was trading stronger yesterday on news of economic weakness in Europe. Weakness in other economic areas leads investors to flock to more “safe” American investments. While beneficial for US financial instruments, the stronger dollar makes commodities relatively more expensive for all other countries, which reduces demand and therefore sends oil prices lower.

Floods in the Midwest have had a severe impact on fueling economics this week, with continued impacts expected over the coming week. Flooding has taken rail infrastructure offline, cutting off distribution of ethanol to other areas. Along with creating octane challenges for gasoline (ethanol is used to boost lower octane fuels to 87 octane). Severe impacts will be felt in the Gulf Coast, especially Texas and Louisiana, and the West Coast. In some markets, suppliers are shifting from E10 to E0 blends, though some state governments will need to approve these actions from a regulatory standpoint (particularly California). Mansfield will provide more updates as the situation continues.

Read the FUELSNews – Week in Review

This article is part of Crude

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.