Markets Turn to US-China Trade Deal

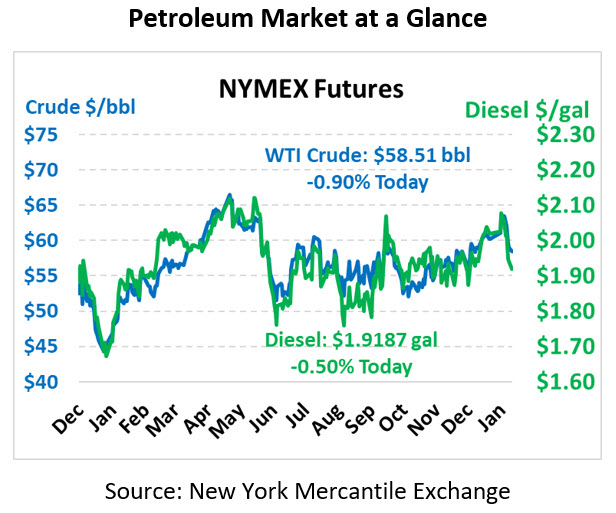

Friday saw oil markets continue their descent to lower territory, extending the streak of losses to four trading sessions. If this morning’s trading patterns hold, it looks like that streak might extend to five days. Crude oil is currently trading at $58.51, 53 cents (0.9%) below Friday’s close.

Fuel prices are trading slightly lower as well. Diesel prices are currently trading at $1.9187, down roughly a penny from Friday’s close. Gasoline prices are $1.6555, down 0.4 cents.

Last week saw oil prices decline 5% week-over-week, a resounding commentary on the market’s lack of interest in Middle East conflict. Neither the US nor Iran are looking to escalate tensions, keeping the situation in check for now. With Iran cooling off, the world turns now to US-China trade.

The Phase 1 deal is expected to be signed by both countries on Wednesday. Despite oil’s decline, equity markets are hovering near record highs as the deal goes into effect. Although the details of the agreement have not yet been announced, US Treasury Secretary Steve Mnuchin said yesterday that China has not altered their stance during the final negotiation and translation stages, a positive indicator that both parties are on the same page. Once markets see the trade deal, expect to see a quick reaction – though that could higher or lower depending on the details.

This article is part of Crude

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.