Markets See 5-Yr Record Drop on New Tariffs

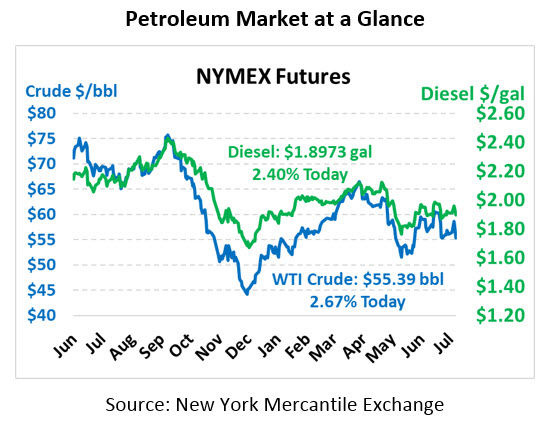

Oil prices plummeted yesterday, experiencing one of the steepest drops in years following Trump’s tariffs announcement. WTI fell by $4.60, the largest single-day drop since November 2014 (and before that, you’d have to look back to 2011 when prices were $80-$90/bbl). Today, the market has rebounded somewhat, with crude up $1.44 to trade at $55.39.

Fuel prices also saw hefty declines over 10 cents. Diesel prices experienced their largest single-day drop since last year when Trump first hinted at Iran sanction waivers and the main training platform for NYMEX HO experienced technical issues causing the decline. Diesel today is trading at $1.8973, up 4.4 cents. Gasoline must look back to post-Harvey price recovery in 2017, when prices fell 40 cents on Sept 1 due to elevated storm prices and a roll to cheaper winter gasoline formulations. Gasoline is currently trading at $1.7820, up 3.2 cents from yesterday’s close.

Trump yesterday announced a 10% tariff on roughly $300 billion of Chinese goods, which will go into effect in September if negotiations do not progress. So far, America has already imposed 25% tariffs on half of China’s goods, so the latest move now covers the second half of traded goods. Notably, while earlier tariffs mainly hit industrial goods, this round now hits consumer goods as well, so consumer spending could fall in response to higher prices. This isn’t the first time Trump has announced tariffs only to pull them back as negotiations succeed, so we’ll see whether the US follows through on the announcement. China has already announced plans to retaliate if the tariffs go into effect.

This article is part of Crude

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.