Markets Leap Despite IMO 2020 Fears Subsiding

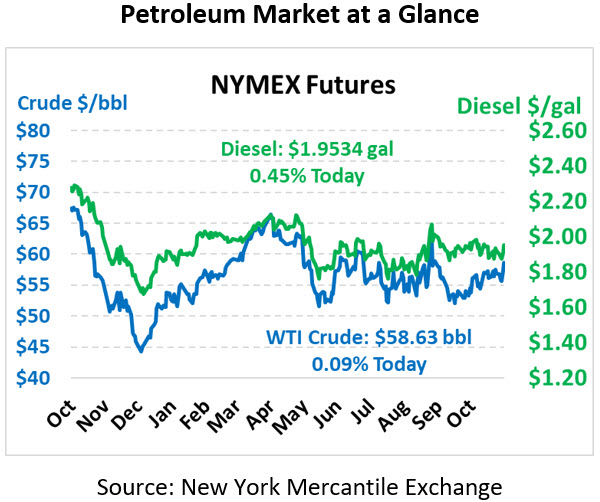

Oil prices were brought to a crescendo yesterday, leading to the highest closing price for crude oil since September. That said, prices remain within the trading range we’ve seen for most of the year, between $50-$60/bbl. Crude oil this morning is trading at $58.63, up a nickel from yesterday’s 2-month high.

Fuel prices also got a boost yesterday, with both products up by more than 5 cents from Wednesday’s close. This morning, diesel prices are trading at $1.9534, down 0.9 cents from yesterday’s close. Gasoline prices are $1.7079, down 0.4 cents.

Markets received some support Wednesday from the EIA’s less bearish inventory report, and those gains carried through to the following day. Of course the usual culprits, China and OPEC, played a part in the large gains as well, with progress in trade talks and support for continued production cuts reported yesterday. But heading into a holiday week, don’t expect to see any impressive rallies in the near future. Oil prices historically experience weak trading and limited action during Thanksgiving week.

IMO 2020 Update

We’re 40 days away from the implementation of IMO 2020, and so far we have not seen the huge swell in prices that many analysts had predicted. What changed that caused the “biggest change ever for oil markets” to turn into a relatively small ordeal?

There were two components of IMO 2020 that spooked the market:

- Crude Oil Prices. A year ago, many feared that there were too many low-tech refineries. These less sophisticated refineries could not be reconfigured to process out more sulfur, requiring those refineries to increase their overall throughput to make more low sulfur fuel along with lots more high-sulfur fuel. This would significantly increase crude oil demand, especially for sweeter crude like US WTI crude, causing prices to rise. This was the foundation of the “oil could go above $150” claims that we heard from prominent analysts like Verleger. Given recent economic conditions, these concerns have largely subsided – there simply isn’t that much demand for crude, and OPEC has so much spare capacity right now that no one fears a shortage.

- Distillate Spreads. The first component makes this one almost a wash. With crude prices low, it’s hard to track the impacts of a 5, 10, even 20 cent increase in distillate spreads (the difference between crude and diesel prices). If crude prices go down 4 cents per gallon while diesel spreads rise 4 cents, consumers won’t see any change in price. The forward curve right now shows backwardation, meaning markets are tighter now than they’re expected to be in the future. Now, diesel crack spreads might rear their heads this winter between HO demand and IMO 2020, but that alone won’t push us to $2.50 or $3.00 diesel. And those will be cleared up by March/April as heating oil demand subsides.

The chart below shows the forward curve for the diesel crack spreads. Currently, diesel crack spreads in January will be just 42 cents per gallon, compared to the EIA’s calls for 65 cent per gallon spreads. That leaves a large gap between current market expectations and previously released analyst forecasts.

Is it still possible for IMO 2020 to sneak up and cause significant supply and price shocks? Yes. If the economy heats up (say, a US-China trade deal that exceeds expectations), US production begins falling rapidly, OPEC undertakes deeper cuts next year – then factor #1 could come back into play. From a consumer standpoint, having a price risk plan is always a good approach, because after months of steady prices, we could see any number of threats arise in the new year.

From a supply standpoint, US markets shouldn’t have any troubles with diesel due to IMO 2020. Our refiners are the best in the world and US consumers are the easiest market for refiners to reach. We may see some brief isolated market impacts in Q1 2020 (particularly in major coastal markets like LA, Miami, Charleston, etc) but it’s doubtful we’ll see anything that truly threatens supply security.

This article is part of Crude

Tagged: China and OPEC, eia, IMO 2020 Update, inventory report, Oil price

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.