Markets Higher, Awaiting EIA Reports

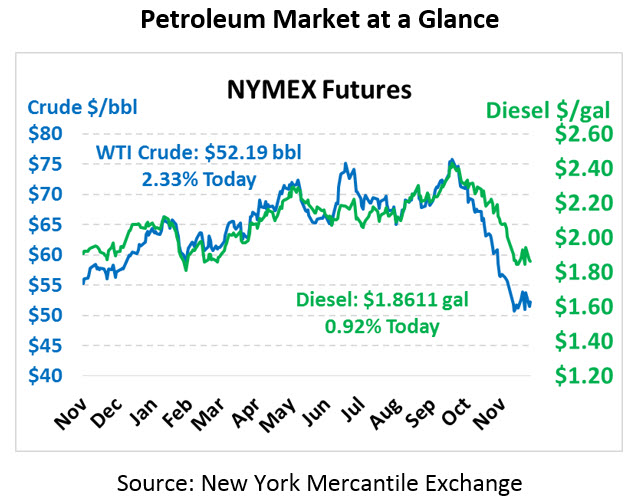

Markets once again took a hit as global equities sold off and the US Dollar rose – together signaling continued weakness in emerging economies. Although the news has been generally bullish lately (including OPEC cuts, Canadian cuts, and Libyan production outages), markets have struggled to break out from the overall bearishness in financial markets. This morning crude oil is trading at $52.19, recovering $1.19 of yesterday’s -$1.61 losses.

Fuel prices are higher in sympathy with crude oil. Diesel prices are currently trading at $1.8611, up 1.7 cents from yesterday. Gasoline prices are $1.4389, a 2 cent gain.

This week the IEA, EIA, and OPEC will all be releasing their monthly reports, providing insight into future market dynamics. Now that OPEC has cut supplies by 1.2 MMbpd, traders will be watching to see how the output cut affects supply/demand balance forecasts. The latest EIA report predicted a net build of 0.6 MMbpd in 2019, so the OPEC supply cut should help bring balance to the market, even if demand forecasts are revised lower.

This article is part of Daily Market News & Insights

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.