Markets Give Up Friday’s Gains

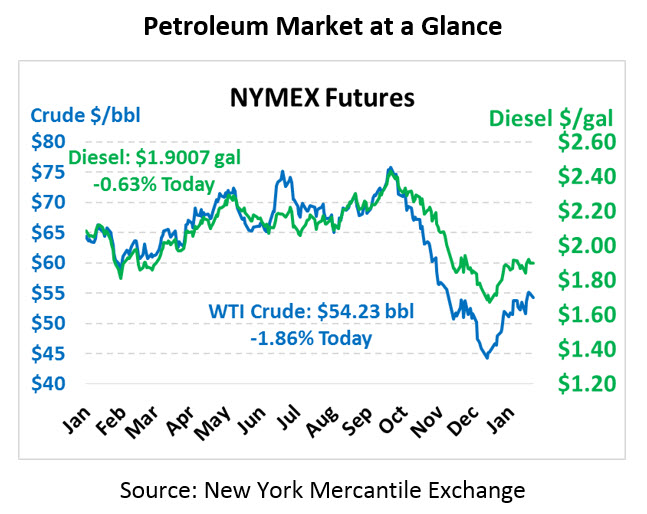

WTI climbed higher on Friday to close above $55, the highest close since November 19. This morning, prices have turned lower and given up most of Friday’s gains amid profit taking. Crude oil is currently trading at $54.23, down $1.03 from Friday’s close.

Fuel prices are also in the red this morning, though prices have retained more of Friday’s gains. After gaining 7.4 cents on Friday, gasoline prices are trading at $1.4358, down 0.1 cents from Friday’s close. Diesel prices are trading at $1.9007, shedding 1.2 cents after picking up 3.4 cents on Friday.

Clarifications on US sanctions on Venezuela have revealed that secondary sanctions will be applied to other countries doing business with Venezuela, though those will be less severe than the sanctions placed on Iran last year. Some European buyers have begun to wind down Venezuelan crude purchases in response to the sanctions. Venezuela is shaping up to be one of the defining markets for the first half of 2019 – if their crude production plummets due to sanctions, it will cause markets to shift from balanced to undersupply very quickly.

CFTC data is catching up with its backlog of reports now that the government is open. CFTC data, among other uses, is used to assess long and short positions in the market, which indicates how bullish hedge funds and small speculators are. The last few reports at the end of 2018 showed a steep downturn in net long positions (total bets that prices will go up minus bets that prices will fall). With prices rallying $10 since that time, analysts expect the market has taken a bullish turn, but are waiting for data to be released this week to see how much more bullish traders have become.

This article is part of Crude

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.