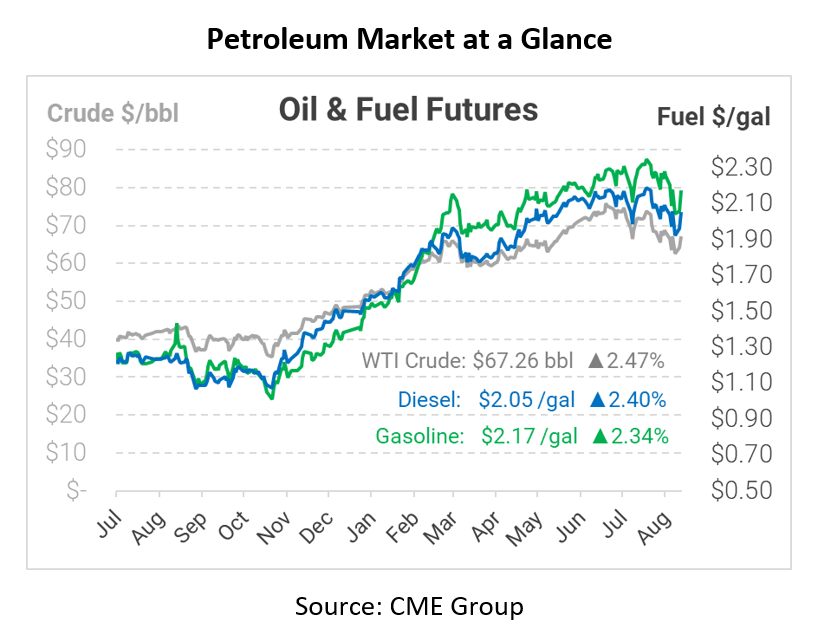

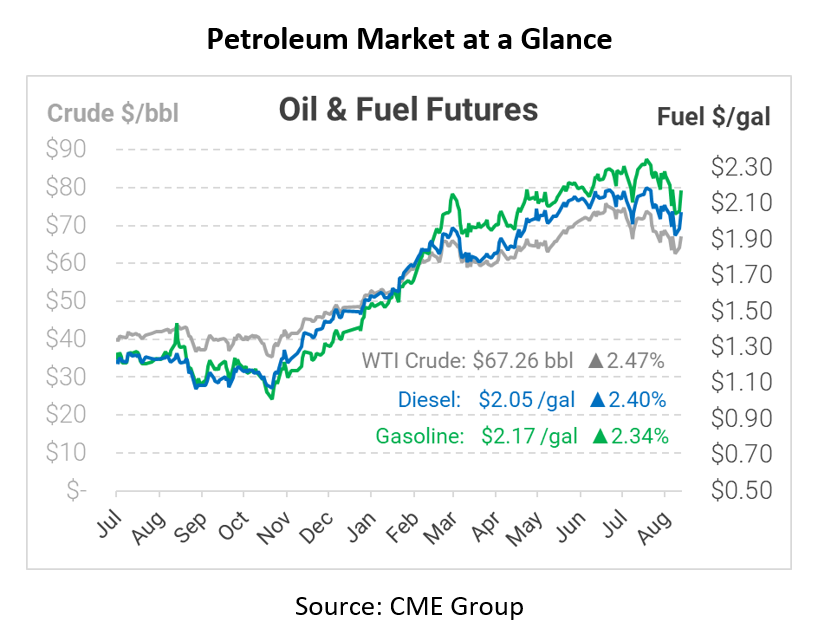

Markets Bounce Back, Fuel Up 14 Cents in Two Days

Across the board, financial markets are responding favorably to the FDA approval of Pfizer’s COVID vaccine. Health experts believe the decision will instill confidence for those hesitant about getting the jab, increasing vaccination rates in the US and abroad. Moreover, China reported no new COVID cases yesterday for the first time in a month, another sign that the Delta wave may be slowing. Crude oil lept by over 5% yesterday, and fuel prices soared 10 cents higher. Those gains continue this morning, with WTI crude up $1.50 and fuel prices up another 4 cents.

Goldman Sachs recently described the market as “oversold”, noting that prices have fallen faster than fundamentals justify. Rising COVID cases have spooked investors, but the supposed slowdown in economic activity has been slower to materialize. Demand continues rising, albeit at a lessened pace, and supply remains tight despite OPEC+ supply increases. The outlook for oil markets remains strong, and the recent price slump seems to be a good opportunity for fuel buyers to layer in hedged fuel volume to counteract potentially higher prices in the future.

In international news, a fire on a Mexican oil platform shut off 400 kbpd of crude oil production, an amount equivalent to OPEC+’s monthly supply increase. Five employees were killed and several were injured due to the blast. The outage takes a quarter of Mexico’s total oil supply offline, and the national oil company, Pemex, is working quickly to resume operations. The first few oil wells are expected to begin production again later this week.

This article is part of COVID-19

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.