Markets are Feeling…Safe?

FUELSNews 360 – Fresh off the press! Download your copy today! Read more below.

Market Update Webinar: Industry Experts Face off on Fuel Prices and Supply Sign Up Now! Learn more below.

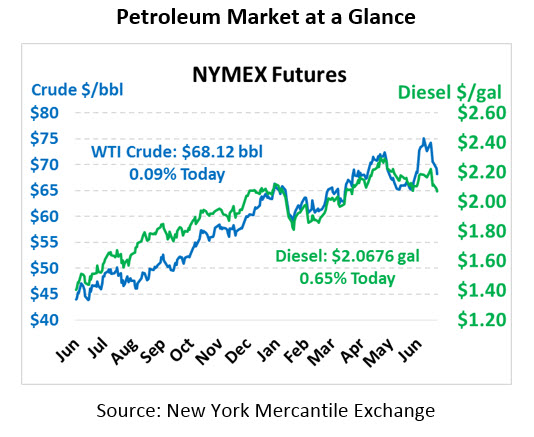

Markets plummeted nearly $3/bbl yesterday, taking prices starkly below $70/bbl once again. This morning markets are taking a bit of a breather. Crude prices this morning are trading mostly flat at $68.12.

Fuel prices also saw massive losses yesterday – twice now this year, gasoline prices have dropped more than 10 cents in a day. Diesel prices also lost almost 8 cents. This morning fuel prices, like crude, have calmed. Both diesel and gasoline have recovered just over a penny of yesterday’s massive losses to trade at $2.0676 and $2.0149 respectively.

As we noted yesterday, markets are taking the probability of a Strategic Petroleum Reserve release quite seriously. Trump has made no official announcement regarding a potential release – and more importantly, an SPR release would only have a temporary effect on markets. Still, the comfort of government action is giving markets pause.

Additionally, production globally is being restored. Saudi Arabia and Russia have both reported increased production over the past month to make up for outages in Venezuela and Iran. Libya is back online after 850 kbpd of exports were cut off at the ports. And the Canadian Syncrude operation has a credible path back to repair, although there will still be an impact on Cushing stocks until September.

Overall, markets are feeling a little bit safer – and thus less bullish – thanks to a wave of supply returning. OPEC is meeting to discuss their production increase further this week, which could add to that safety net. Until markets begin feeling the pressure of Iran sanctions, which don’t become effective until November, prices could remain somewhat calmer. Of course, Libya, Nigeria and other countries could easily experience an outage that takes us back above $70.

FUELSNews 360 – Fresh off the press! Download your copy today!

Learn how key forces and trends are affecting supply, demand and fuel prices in the latest edition of FUELSNews 360°. As a FUELSNews subscriber, we are offering you a complimentary copy – available for download.

FUELSNews 360° Highlights:

- Executive Overview of Q2: Fuel Supply and Price Trends

- Debunking Three Biodiesel Myths

- Hurricane Season is Here – Are you Prepared?

- How to Build a Fool-Proof Fuel Quality Program to Protect Your Fleet

- Impact of IMO 2020 on Fuel Prices

Market Update Webinar: Industry Experts Face off on Fuel Prices and Supply

Fuel prices rose over 20 cents in Q2. We’re bringing together fuel industry pricing and supply experts to give you an overview of what matters, what factors are driving the market and where fuel prices may be headed in Q3. Join this live webinar on July 25 at 1 PM EDT for a fast-paced, Q2 overview with a forecast into Q3.

This article is part of Crude

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.