Market is Cautious Ahead of OPEC+ Meeting

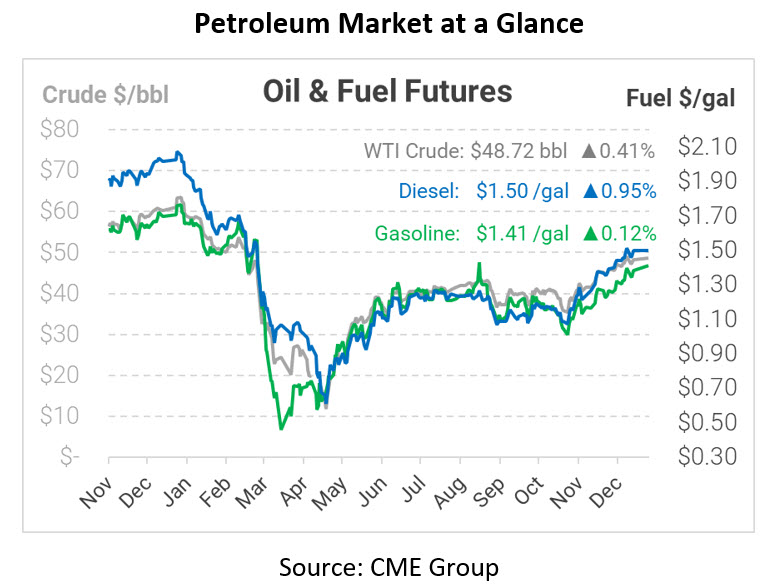

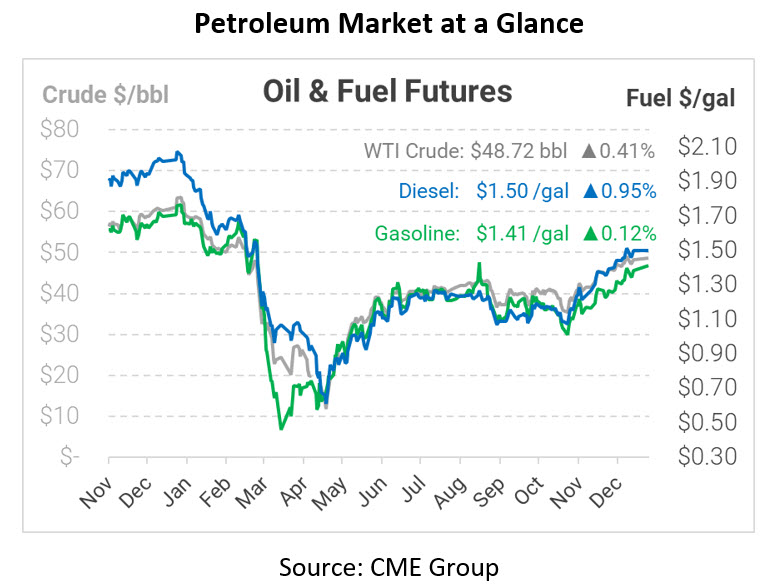

We’re finally in 2021, and 2020 was a wild ride that saw prices sink to negative $37.63 and rally to close the year at $48.52. In the last two months of the year, prices rallied $12.73.

This morning crude is up slightly ahead of an OPEC+ meeting to be held today to discuss February output levels. Putting upward pressure on the market is the first coronavirus stimulus direct deposits hitting bank accounts in the US. The long-awaited stimulus is less than the $2,000 amount demanded by President Trump but is welcomed by experts who note that people are in need, and the economy could use a jolt to keep it moving forward.

At the OPEC+ meeting scheduled for today, the market expects OPEC+ to remain cautious. Secretary-General of OPEC, Mohammad Barkindo, said on Sunday that, “While crude demand is expected to rise by 5.9 MMbpd to 95.9 MMbpd this year, the group sees plenty of downside demand risks in the first half of 2021.” There has been some chatter among members about increasing production by 2 MMbpd. However, experts believe OPEC+ will choose not to increase output for February amid rising COVID-19 cases worldwide and the slower-than-expected vaccine rollout. The market and traders are watching OPEC+ closely and taking the expectations cautiously.

In early trading today, crude prices are up slightly. Crude is currently trading at $48.72, a gain of 20 cents.

Fuel prices are up this morning. Diesel is trading at $1.4981, a gain of 1.4 cents. Gasoline is trading at $1.4118, a gain of 0.2 cents.

This article is part of Daily Market News & Insights

Tagged: coronavirus, opec, Supply

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.