Made-in-America Crude Will Rise in April

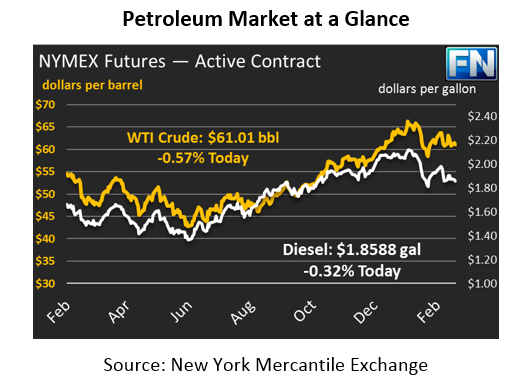

Markets are heading lower this week, after some minor losses yesterday. Daily price changes have grown more volatile recently, with $1+ price changes in four of the last six trading sessions. Today, crude oil is currently trading 35 cents below yesterday’s closing price, at $61.05.

Fuel prices are also on the downward trek, though gasoline’s performance has been stronger lately as markets gear up for summer driving season. That trend has changed this morning, with gasoline down 2.3 cents (1.3%) at $1.8712. Diesel prices, on the other hand, have lower negative pressure, down just 0.6 cents to $1.8588.

Made in America

The EIA released production data yesterday based on the different shale regions and markets grew anxious at their forecast for April. The government agency showed estimated total March 2018 production to be 6.82 million barrels per day (MMbpd) from the shale regions, rising still higher to 6.95 MMbpd in April.

Of course, shale oil production does not account for total U.S. production – the U.S. produces over 10 MMbpd according to the latest weekly EIA data. Shale regions account for the majority of the production growth over the past year, so the 130 thousand barrel per day (kbpd) increase in April will yield to significant overall growth.

That production increase is important given the 11-week streak of crude draws from Cushing, OK inventories. The delivery point of WTI crude, Cushing stocks are an important metric for oil markets. When stocks in Cushing fall too low, it boosts the price of WTI crude oil, the main index for oil in the U.S. More crude production in shale regions near Cushing could replenish Cushing inventories, sending oil prices (and fuel prices) lower.

Libya Export Disruption

This morning, markets received temporary support from an oil disruption in Libya. A strike at a major Libyan port has cut off oil exports from Libya’s large El Sharara oil field, which produces over 300 kbpd of crude oil. Libya has been a constant source of volatility over the past year. Strikes, terrorist attacks and logistics issues have all played a part in making Libya one of the biggest sources of volatility in the market.

As we’ve noted in the past, lower crude inventories make any supply disruption more important for markets. With less slack in the supply chain, outages can cause volatility in prices. WTI prices jumped 40 cents immediately after the Libyan outage was reported, though markets have since given up those gains and more as markets remember yesterday’s EIA report. The result has been a big upswing followed by a major dip in prices.

This article is part of Crude

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.