Libyan Oil Disruption has Minimal Price Impacts

Over the weekend, crude prices traded higher during the Asian morning session after the Libyan National Army closed the country’s eastern oil export terminals. Libya’s National Oil Corporation declared a force majeure on Saturday, following the loss of 800 kbpd of exports, 2/3rds of Libya’s recent production; this was a political move ahead of the Berlin peace talks on Sunday that ended with nothing more substantial than an agreement to set up a cease-fire committee. Libyan oil disruption only had a minimal initial impact on prices. No actual infrastructure was damaged, and crude could flow easily if an agreement is reached.

Assuming a ceasefire is actually signed off, the EU may deploy a peace-keeping force in Libya; the UN is pushing for a meeting between representatives of both Haftar’s group and the internationally recognized government in the coming days. The US has called for an “immediate resumption” of Libya’s production after the Libyan NOC confirmed that production will reach near zero in 3-4 days as storage tanks will be full.

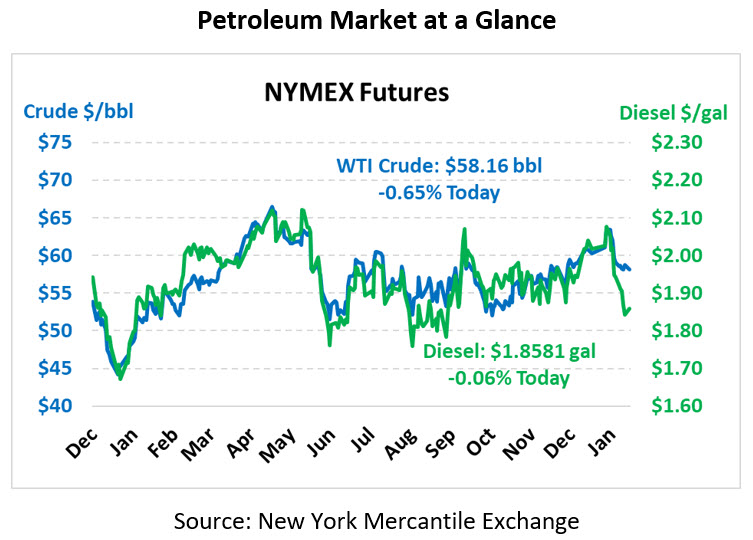

Crude prices are down this morning after the IMF lowered its 2020 global growth forecast to 3.3% from 3.4% in October (up from 2.9% in 2019). Crude is down in early trading this morning. Crude is currently trading at $58.16, a loss of 38 cents.

Fuel prices are flat. Diesel is trading at $1.8581, a loss of 0.1 cents. Gasoline is trading at $1.6355, a loss of 0.5 cents.

This article is part of Crude

Tagged: Libyan National Army, Libyan Oil Disruption, Price Impacts, US

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.