Let’s Start a (Libyan) Riot

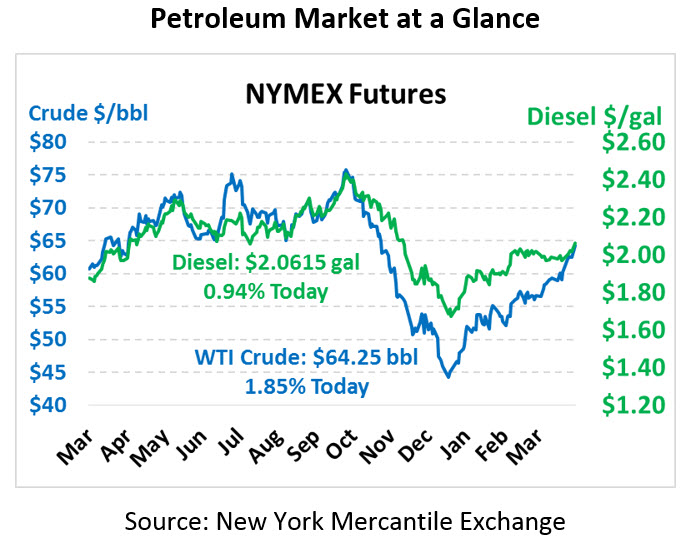

Oil is accelerating higher as strong job reports in the US signaled a more robust economy than previous assessments had indicated. WTI crude is currently gaining ground on Brent, with spreads narrowing to less than $7/bbl after trading in the $9-$10 region for most of 2019. This afternoon, WTI is currently trading at $64.25, up $1.17 (1.9%) from Friday’s close.

Fuel prices have also felt the upward pressure, with diesel trading at its highest level since November 2018 and gasoline nearing $2/gal for the first time since October last year. Diesel prices are currently hovering at $2.0615, up 1.9 cents (0.9%) from Monday’s close. Gasoline prices are trading at $1.9866, up 1.8 cents (0.9%).

Markets are adding some risk premium early this week amid instability in Libya, a country that has long been riddled with instability. Bombings at the Tripoli airport have further escalated the situation. At least 300 kbpd of crude output is at risk in the country, which only just recently resumed operations at its largest oil field, El Sharara. US troops stationed in the area had to be withdrawn after rebel militias launched a surprise offensive on the capital. The attacking Libyan National Army is attempting to take control of the country before UN talks begin next week. At least 35 people have been killed since attacks began last Thursday.

While Libyan output appears on the cusp of sinking lower again, Saudi Arabia’s output is likely as low as it will go, according to Saudi Energy Minister Al-Falih. The kingdom believes oil markets are moving in the right direction now, though he pointed out that global stocks remain 70-80 million barrels too high. The comments suggest that Saudi won’t keep cutting output lower, though his remarks also don’t necessarily suggest they’ll raise output in the near future. Russia’s head of state direct investments noted that an OPEC deal could extend beyond June depending on market needs, but the deal could potentially allow for higher production.

This article is part of Crude

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.