Large Crude Build Sends Prices Lower

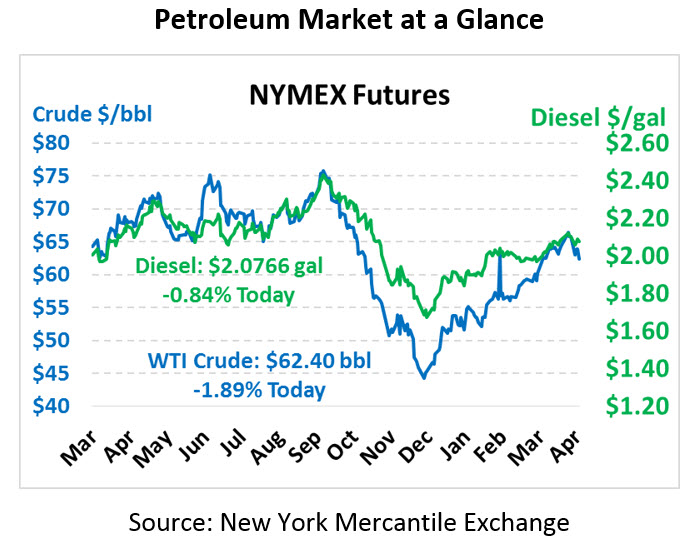

Yesterday’s losses are spilling over to today, responding to the hefty crude oil build and the surprise gasoline build. Crude oil is trading at $62.40, a loss of $1.20.

Fuel is following crude lower this morning with diesel trading at $2.0766, down 1.8 cents. Gasoline is trading at $2.0338, a loss of 3 cents.

The EIA’s data largely confirmed the API’s forecast, showing a large crude oil build of almost 10 million barrels for the week, nearly all of it coming in PADD 3 (Gulf Coast). It’s hard to point to a single cause behind the build – the data shows that imports were a bit higher than last week, exports a bit lower, US production was slightly up and refinery runs were down. The gasoline build does go against recent trends such as strong demand and refinery outages, but small builds in late April are not atypical historically.

OPEC is considering all options as it evaluates extending production cuts in the second half of 2019, according to OPEC Secretary General Barkindo. With Iran and Venezuela production at historically low levels, OPEC members have more room to increase production without raising the group’s overall cap. Despite the leeway, Russian production came in just over quota levels by the end of April, and energy minister Novak has numerous times indicated Russia’s commitment to comply, at least in the first half of 2019.

This article is part of Crude

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.