Kansas Fed Reveals Rising Production, Supply Crunch Risk

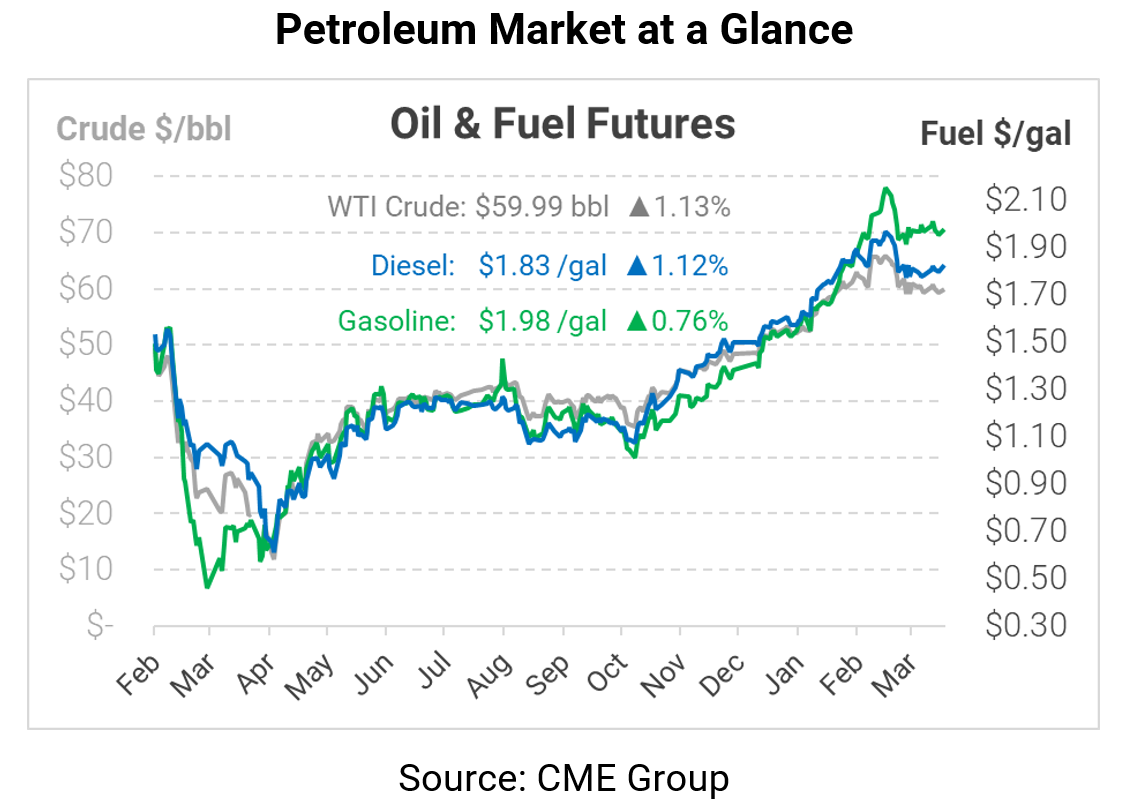

After trading within a tight range last week, oil prices are gradually moving higher this morning. WTI crude crept above $60/bbl earlier this morning; if it can rise again and maintain that level, it would be the highest closing price since April 1. A weaker dollar this morning is proving supportive for oil prices, even as broader financial markets are pulled down by rising COVID cases.

Last week, the Kansas City Federal Reserve published their quarterly energy survey, which provided insights on several key questions regarding energy production. Although the report found that year-over-year drilling activity was up for the first time since 2019, there were also some notes of pessimism. Among the most interesting results:

- US producers need, on average, $53/bbl oil to be productive.

- Producers generally expect prices to gradually continue rising over the next five years, reaching $65 in 2022, $67 in 2023, and $70 by 2026

- Asked about a potential supply crunch in 2021, 42% of producers believe it will happen, while 37% say no. The rest are unsure.

- While $53/bbl is an important breakeven, producers still need financing to expand production. This year, it seems that financing is slowly becoming more available, with 60% of firms saying it’s more available.

On Friday, the Biden administration chose to allow the Dakota Access Pipeline to remain operational while the US Army Corps of Engineers (USACE) conducts an environmental impact assessment. The federal court ruled that while the federal government has the authority to shut down the pipeline, it would not use it “at this time.”

The Dakota Access Pipeline delivers nearly half a million barrels of Bakken oil per day to Illinois’s Pakota crude trading hub, so its closure would have had a big impact on Midwest fuel prices and on North Dakota oil producers. The situation began with a faulty environmental assessment, leading the USACE to conduct another assessment, scheduled to be finished in March 2022. There’s still a risk of a shutdown if the USACE changes its stance over the next few weeks, since the ruling allowed a 10-day period for briefings to be filed.

This article is part of Daily Market News & Insights

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.